HUGE INSIGHTS: The Big Picture - Issue #29

2024 Investment Outlook

Please enjoy the free portion of this monthly newsletter with our compliments. To get full access, you might want to consider an upgrade to paid for as little as $12.50/month. As an added bonus, paid subscribers also receive our weekly ALPHA INSIGHTS: Idea Generator Lab publication, which details our top actionable trade idea and provides updated market analysis every Wednesday, as well as other random perks, including periodic ALPHA INSIGHTS: Interim Bulletin reports and quarterly video content.

Executive Summary

The Debt Clock Strikes $34 Trillion

The 10th Man Rule

Geopolitical Perspective: Fed, Iran, & the Red Sea

Market Analysis & Outlook: The Gambler’s Fallacy

Conclusions & Positioning: Adventures in Biotech

The Debt Clock Strikes $34 Trillion

On June 24, 2021, Champlain Towers South — a 12-story beachfront condominium complex in Surfside, Florida — partially collapsed in the middle of the night. It was determined that the pool deck suffered a partial collapse at about 1:14 AM, followed by a progressive collapse of the central section and eastern wing of the building at 1:22 AM — approximately 8 minutes later. Surveillance footage showed that the collapse of the building lasted less than 12 seconds. Tragically, ninety-eight people lost their lives that day. Eleven others were severely injured. The Surfside collapse is tied with the Knickerbocker Theater collapse in 1922 as the third-deadliest non-deliberate structural engineering failure in U.S. history, behind the Hyatt Regency walkway collapse in 1981 and the collapse of the Pemberton Mill in 1860.

On June 25th, the National Institute of Standards and Technology (NIST) deployed a team of six scientists and engineers to collect firsthand information on the collapse. Five days later, NIST announced that it was launching a full investigation of the collapse under the National Construction Safety Team Act. After two and a half years, a review of the evidence by investigators, which has been exhaustively vetted by reporters from the Miami Herald — earning the collective 37-person staff of the newspaper the 2022 Pulitzer Prize for its investigative reporting on the collapse and its causes, has revealed a startling conclusion.

Out of the almost two dozen potential causes being investigated by NIST, the most important contributing factor to the building’s failure has been determined to be the long-term degradation of the reinforced concrete structural supports in the basement-level parking garage under the pool deck, due to water penetration and corrosion of the reinforcing steel. The problems had been originally reported in 2018, and noted as “much worse” in April 2021. A $15 million program of remedial works had been approved by the condominium association before the collapse, but the main structural work had not yet begun. Why are we writing about a structural engineering disaster that took place almost three years ago? It’s a metaphor.

On August 5, 2011, Standard & Poor’s reduced its credit rating on U.S. government debt from AAA to AA+ after first announcing a negative outlook in April of the same year. On May 24, 2023, in response to the U.S. debt-ceiling crisis, Fitch placed its AAA credit rating for the U.S. on a negative watch. Less than three months later, Fitch also downgraded its rating from AAA to AA+. On November 10th, Moody’s lowered its credit rating outlook on U.S. government debt from stable to negative. Does anyone want to hazard a guess as to what comes next?

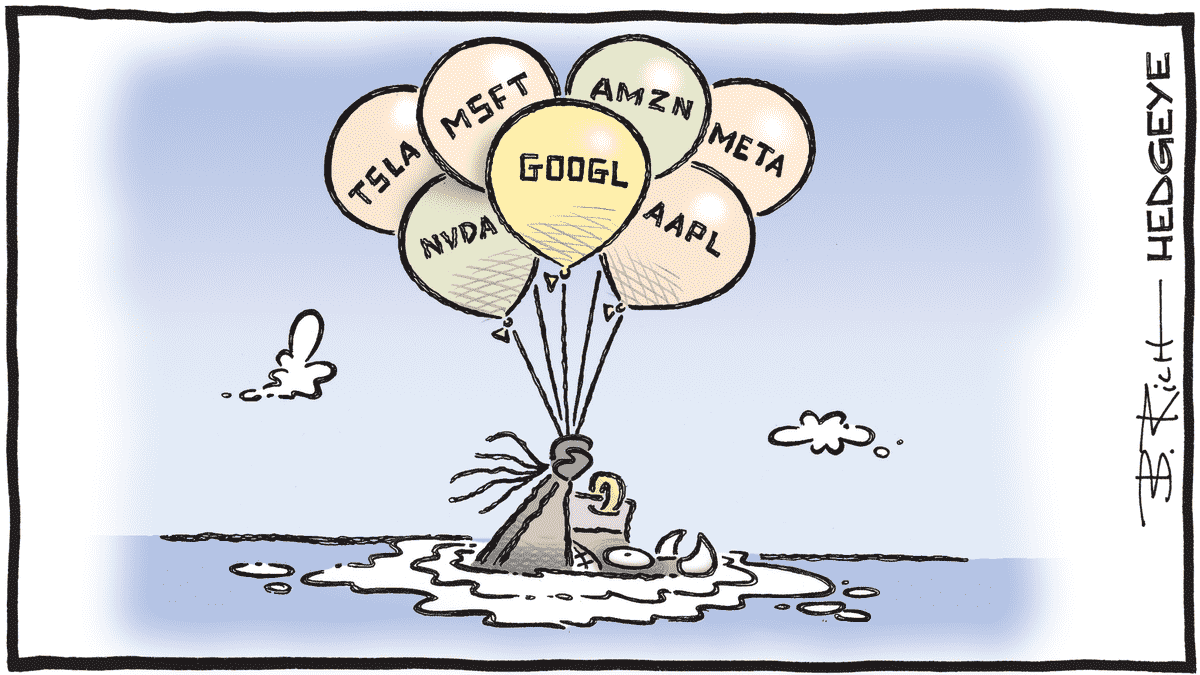

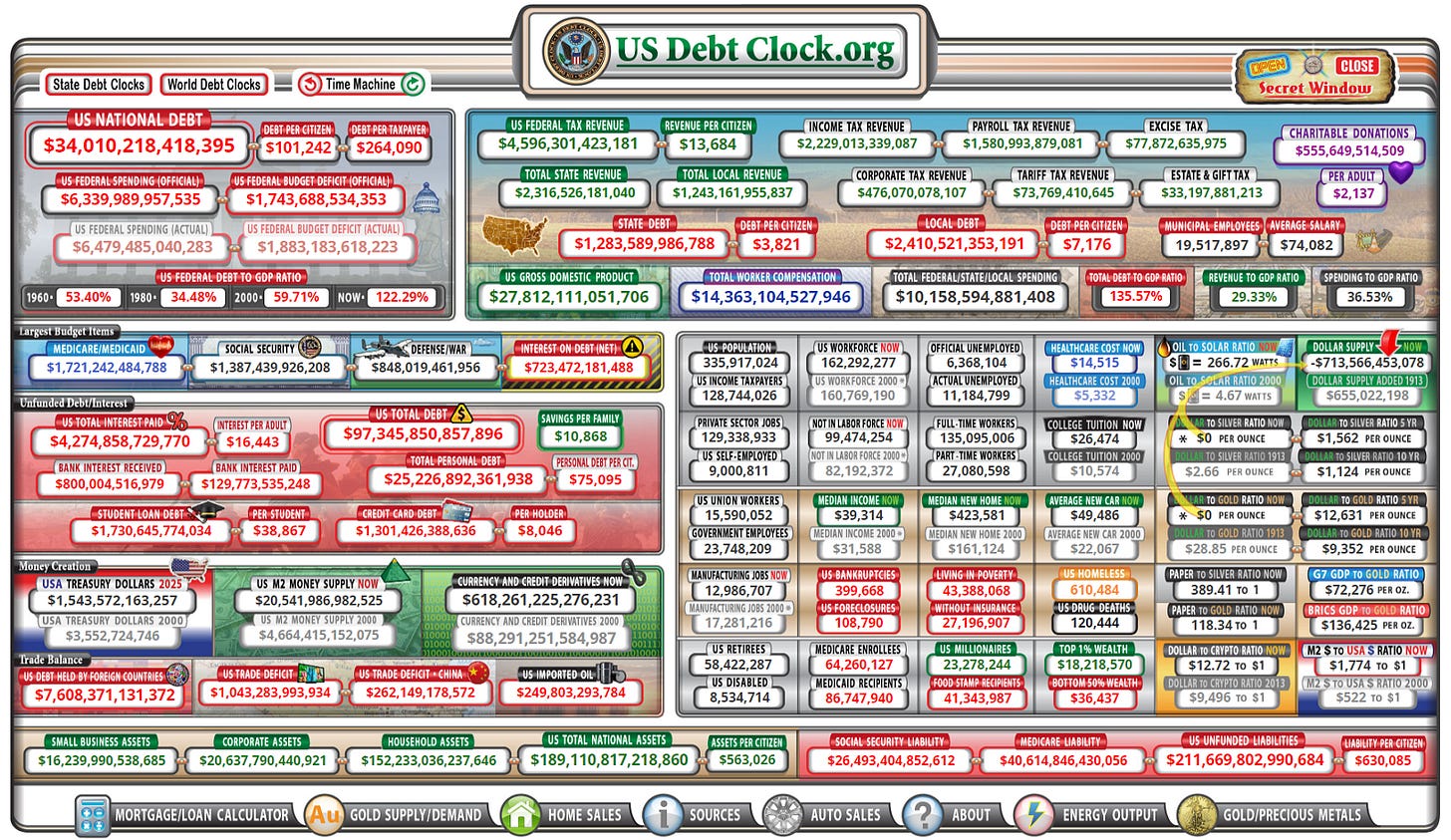

The stability of the global financial system rests upon the perceived safety of the sovereign debt of the United States of America. When that perception of safety is questioned, bad things can happen. As detailed in Issue #27, the problems with the U.S. budget deficit are well known (corrosion of the reinforcing steel). The ballooning national debt, as discussed in Issue # 26, is not a secret — it is the elephant in the room (long-term degradation of the structural supports). Congress (the condominium association) has been talking about the problem for years, but the structural work has not yet begun. In 2011, when the first of the three big credit rating agencies cut their rating on the U.S., the national debt was a mere $14.8 trillion. Today, it’s “much worse” — having just crossed above the $34 trillion mark.

Last Fall, Congress passed two stopgap measures that temporarily funded the government into the new year. On January 19th, the funding for federal transportation programs, housing and food plans, and other resources will expire. Funding for the Departments of Health and Human Services, Commerce, Labor, State, and Defense expires two weeks later on February 2nd. According to various media sources, the path to meet both deadlines is liable to be rocky. House Speaker Mike Johnson, who passed the latest funding extension in the House with more Democratic votes than Republican votes, faces continued infighting among GOP officials. It remains to be seen if the House majority can come together enough to ratify a 2024 budget accord.

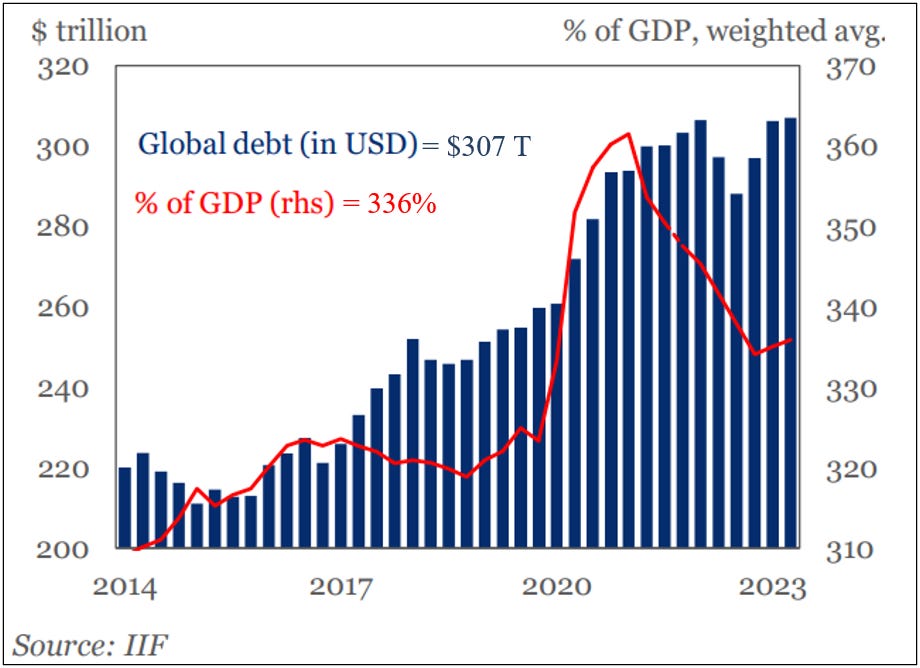

But the budget deficit and debt dilemma in the U.S. is only a part of a much larger, and more comprehensive problem. According to a recent report by the Institute of International Finance, the global debt burden increased by $10 trillion in the first half of 2023 to a new all-time record high of $307 trillion — a staggering $100 trillion more than it was just a decade ago. Over 80% of the 1H23 buildup came from developed economies led by the U.S., Japan, the U.K., and France — with the remaining 20% emanating from emerging economies dominated by China, India, and Brazil.

After declining for seven consecutive quarters, the global debt-to-GDP ratio resumed its upward trajectory in the first two quarters of last year, reaching 336%. As discussed in Issue #25, research conducted by Reinhart and Rogoff, examining data from 44 countries and spanning two centuries, concluded that high debt-to-GDP ratios of over 90%, across both developed and emerging economies, are associated with notably lower growth outcomes, and seldom do countries grow their way out of debt.

We believe that outcomes are initial conditions dependent. Given the unprecedented degree of global leverage in the system, we have become increasingly concerned about the consequences from a potential third downgrade of U.S. credit worthiness. There is a high probability that Congress will again fail to reach a budget accord before the aforementioned deadlines, and attempt to simply kick the can down the road again. This could trigger a negative response from Moody’s, resulting in another downgrade. Moreover, any delay in implementing the appropriate steps necessary to remedy the structural problems associated with the nation’s growing fiscal budget deficit and ballooning national debt burden could result in an eventual collapse in confidence in the U.S. dollar as the world’s reserve currency (1:14 AM), followed by a progressive collapse in global financial stability (1:22 AM — approximately 8 minutes later).

The 10th Man Rule

The Devil’s Advocate Unit is a small cohort within the Israeli Military Intelligence Directorate whose purpose is to evaluate intelligence assumptions and procedures in a professional and critical manner. It was founded after the Yom Kippur War of 1973 — as part of the implementation of the Agranat Commission recommendations, in order to play the role of “Devil’s advocate” to Mossad. The unit works independently of the Mossad Research Department. Their primary directive is to examine unlikely scenarios and question the common assumptions of the Research Department, as well as to propose adversarial evaluations. The 2013 film, World War Z, starring Brad Pitt, referenced it as the 10th Man Rule. A senior Mossad officer in the film states, “If nine of us look at the same information and arrive at the exact same conclusion, it is the duty of the 10th man to disagree.” Consider us the 10th man.

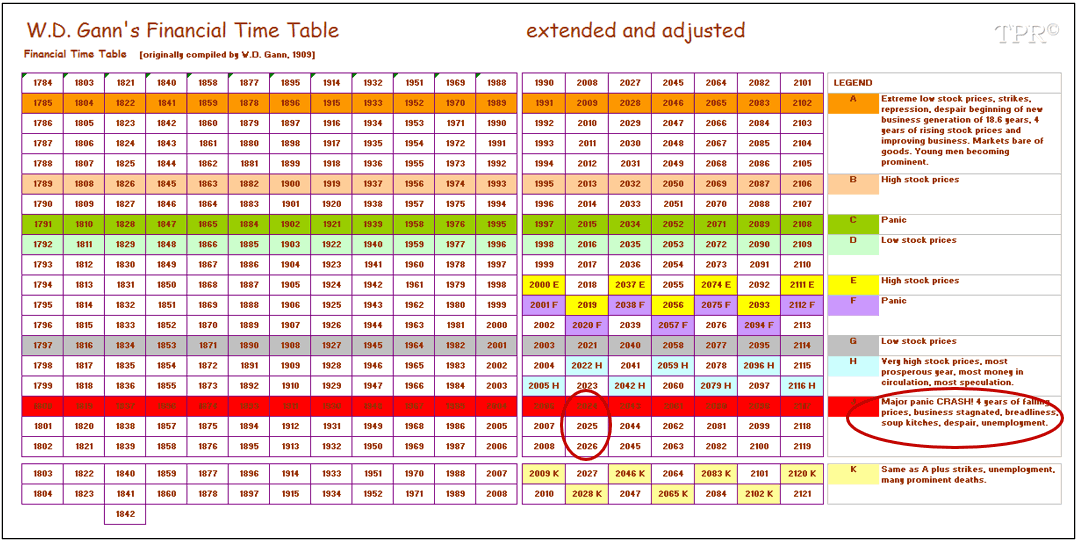

In 1909, famed market forecaster W.D. Gann devised and published his Financial Time Table. Below, we’ve included an extended version of the original, which ended in 2008. It is based upon the 18.6-year lunar declination cycle. While Gann is best known for his use of geometry and harmonics in the creation of such cycle tools including the Spiral Chart (or Square of Nine), the Hexagon Chart, and the Circle of 360, Gann’s forecasting methods were also based upon inferences drawn from astronomy and astrology. He was a student of the ancient Greek and Egyptian cultures, as well as a great student of the Bible, and he was also a 33rd degree Freemason of the Scottish Rite Order. Gann believed, “Time is more important than price. When time is up, price will reverse.”

At this point, we will assume that every self-respecting CFA in the audience has pressed delete and moved onto their next email, so we can now get to the point of this discussion. Of course Gann’s 18.6-year lunar declination cycle is ridiculous. Of course it should be dismissed as nonsense. Of course it should be ignored by any serious student of finance. We all know that the reason the stock market goes up or down is because of its long-term relationship to earnings, right? Maybe. But, as the 10th man, it is our duty to disagree.

Instead, we must examine unlikely scenarios and question the common assumptions. This means that we must take Gann’s work seriously, and critically examine his conclusions. Since 1909, based upon the expected outcomes for each period A through K, indicated in the legend to the far right of each row, the table has correctly identified the following: A low in stock prices in 1922 and a high in stock prices in 1929; A major panic and crash in stock prices, along with breadlines and soup kitchens from 1930-32; A high for stock prices in 1946 and a low for stock prices in 1950; A panic in 1962; A high in 1966; A panic and crash in 1968, followed by a low in 1970; A panic in 1976 and a low in 1978; A low for stock prices in 1982; A crash in 1987; A low in 1990; A high in 2000, followed by a panic in 2001-02; A major panic and crash in 2008; An extreme low for stock prices in 2009; A panic in 2015, followed by a low in 2016; A high in 2018; A panic in 2020; And a high in 2022.

Gann’s 18.6-year lunar declination cycle is currently forecasting a major panic and crash in 2024, to be followed by 4-years of falling stock prices, which are then slated for an extreme price low in 2027. Could a downgrade of the U.S. credit rating by Moody’s be the catalyst for a global financial calamity? We don’t know. Have Gann’s forecasts been perfect? Of course not. Is the 18.6-year lunar cycle nonsense? Possibly. Should it be ignored? Considering its track record, probably not. All we’re suggesting from this exercise is that investors keep an open mind about all of the possibilities that exist. Gann’s Financial Time Table does not have all the answers, but it’s our view that when considered in the light of all other available evidence, Gann’s work does have the potential to add incremental value to one’s analysis.

So how do we explain the success of this cycle? We’re not certain, but mankind’s interest in the 18.6-year lunar declination cycle dates back 5,000 years to Stonehenge. According to Dr. Judith Young, Professor of Astronomy at the University of Massachusetts, Amherst, the current 18.6-year lunar declination cycle will reach its culmination in 2024 known as the Major Lunar Standstill. This condition will persist into 2025. Over the subsequent three years, the lunar declination changes very little. The last time this occurred was in 2006 and it lasted through 2008. We would file that information under the reference: Things That Make You Go Hmmm.

Separately, the U.S. Department of Justice produced a study entitled, Lunar Effect — Biological Tides and Human Emotions, which was designed to look at the effects of lunar periodicity on aggressive behavior and crime rates. It engaged in an extensive analysis of data on human behavior and lunar astronomy that concluded that the repression of the moon’s gravitational influence brings about social tension, disharmony, and bizarre results. The study found through empirical observations, research, and a synthesis of findings in physics, astronomy, biology, and psychology that the force of gravity can be shown to interact with the forces of human evolution and behavior, and that gravity directly influences the human nervous system and may make persons more irritable. The study also found that people with unstable personalities and mood disorders may experience social consequences of excessive cosmic influence, and that if such persons are prone to violence, they may be compelled into uncontrollable behavior.

Geopolitical Perspective: Fed, Iran, & the Red Sea

Throughout the past two months, the financial news media has overwhelmingly embraced the “soft landing” economic narrative, trotting out a slew of bullish pundits’ day after day, from Wall Street strategists and economists, to Boston portfolio managers, and even a number of bulge bracket financial advisors, in order to reinforce that view. To be sure, despite Fed Chairman Powell’s stated remarks following the FOMC meeting on December 13th that, “Inflation has eased over the past year, but remains elevated,” the so-called “dot plot” showed that Fed officials expect to lower rates by 75 bps in 2024, a sharper pace of cuts than was indicated in September.

This fact has been heralded by the financial news media as the definitive “Fed Pivot.” But was it? Both stock and bond investors certainly appear to be reacting as though it was, leaving both markets priced for perfection at year-end. Indeed, the market is now pricing in six rate cuts in 2024. Yet, history shows that the Fed only cuts rates to that extent when there’s a crisis. Moreover, by definition, it also means geopolitical risk has been dramatically underpriced by the market in recent months. Following the perceived success of a surprise attack on Israel by Hamas on October 7th, which tragically claimed the lives of some 1,200 Israeli citizens, other Iranian-backed terrorist groups have become emboldened to engage in military attacks on U.S. ships and bases in the region.

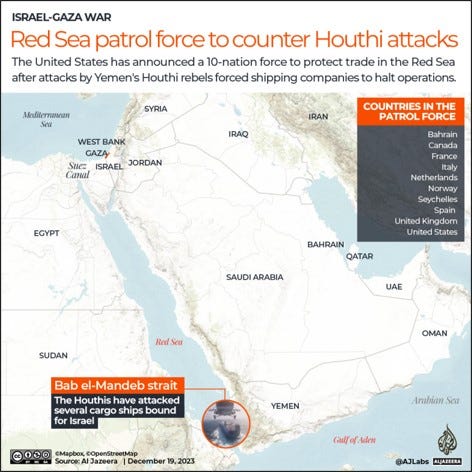

Enter Houthis. With all eyes trained on Israel’s counter-offensive against Hamas in the Gaza strip, the Yemen-based, Iranian-backed Houthis rebel terrorist faction has more recently begun targeting commercial freight liners, including container ships and oil tankers passing through the Red Sea to access the Suez Canal. The implication is that approximately 12% of the world’s seaborne trade could be negatively impacted as long as the attacks continue. Shipping giant Maersk announced on Friday that it will suspend all shipping through the Red Sea for the “foreseeable future” because of the threat of attacks on vessels using that vital maritime trade route.