HUGE INSIGHTS: The Big Picture - Issue #25

This is Water

Please enjoy the free portion of this monthly newsletter with our compliments. To get full access, you might want to consider an upgrade to paid for as little as $12.50/month. As an added bonus, paid subscribers also receive our weekly ALPHA INSIGHTS: Idea Generator Lab publication, which details our top actionable trade idea and provides updated market analysis every Wednesday, as well as other random perks, including periodic ALPHA INSIGHTS: Interim Bulletin reports and quarterly video content.

“There are these two young fish swimming along and they happen to meet an older fish swimming the other way, who nods at them and says, ‘Morning boys. How’s the water?’ And the two young fish swim on for a bit, until eventually one of them looks over at the other and says, ‘What the hell is water?’”

Some of our readers may recognize this story as the opening lines from David Foster Wallace’s commencement address to the 2005 graduating class of Kenyon College. In 2017, Time magazine ranked it among the 10 best commencement speeches ever delivered. Therein, the celebrated author outlined his views on education and life, although his untimely suicide may have subsequently rendered those views unsalable. While his speech had nothing to do with the economy or the markets, Wallace further elaborated that the moral of the fish story is merely that the most obvious, and important realities are often the ones that are the hardest to see. We were inspired by the story’s moral, and wanted to present it here in order to facilitate the connection that we see between the fish story and the most obvious and important reality affecting the U.S. economy: its dependence upon debt — and by extension, the impending debt crisis that we believe could lie ahead if a course correction is not implemented soon.

Just as the two young fish are completely unaware of the existence of water — even though they are completely surrounded by it, and dependent upon it for their very survival, so are most Americans completely unaware that their economic survival is completely dependent upon an ever expanding debt load. Unfortunately, the amount of debt that an economy can support is limited by its GDP growth. But the condition goes well beyond the U.S. national debt ($32.8T), which supports our annual fiscal budget deficit — now at record levels (-$1.5T). Or even State and local government debt ($3.2T). American households are also immersed in record levels of consumer debt: mortgage debt ($12.0T), auto loan debt ($1.6T), student loan debt ($1.6T), and credit card debt ($1.0T). In aggregate, according to the Federal Reserve Bank of New York, Americans now owe lenders more than $17 trillion. All told, including government debt, the citizenry of the United State of America owes approximately $53 trillion, or about $160K per person (not including the future cost of entitlements).

No biggie, right? The United States is the wealthiest nation in the history of the world. While that may be true for the moment, it doesn’t change the fact that our borrowing capacity is a function of our ability to repay our debts. As Warren Buffett once astutely pointed out, “It’s not debt per se that overwhelms an individual, corporation or country. Rather it is a continuous increase in debt in relation to income that causes trouble.” Indeed, lenders have reported a significant increase in the percentage of debts that are now over 90 days delinquent — 1.16% as of the end of the second quarter, up from 0.84% a year ago. Notably, the increase in delinquencies is dominated by two categories: credit card debt and auto loan debt, which saw 90 day delinquency rates jump to 5.08% and 4.65%, respectively. With student loan payments set to resume on October 1st, this trend is not likely to improve anytime soon. Even the U.S. government’s credit rating has been called into question in recent weeks. Fitch Ratings downgraded the United States from AAA to AA+, citing concerns over rising deficits and an erosion of governance. But the real elephant in the room is illustrated in the chart below — the dramatic increase in the nation’s debt-to-GDP ratio over the last three years, which now stands at approximately 122%.

So, what’s the problem? It speaks to an economy’s ability to grow. After analyzing data from 44 countries — both advanced and emerging economies — spanning about 200 years, research conducted by Reinhart and Rogoff concluded that countries with high levels of debt — defined as public debt equal to or greater than 90 percent of GDP — experience median growth rates that are about 25 percent lower than countries with average levels of debt — defined as public debt equal to or less than 60 percent of GDP. They further concluded that as debt levels hit these tolerance ceilings, market interest rates tended to rise quite suddenly. In addition, they found very few examples of countries growing their way out of debt. To the contrary, the condition has historically tended to become permanent.

Why is this the case? Reinhart and Rogoff show that as a country’s debt-to-GDP ratio approaches 90 percent, the GDP multiplier effect of an additional dollar of debt falls to 1.0x. At normal levels of debt (below 60 percent debt-to-GDP), the GDP multiplier is about 1.3x — that is, each additional dollar borrowed and spent translates into about $1.30 of incremental GDP. But as the debt-to-GDP ratio approaches 90 percent, the impact of each additional dollar of debt declines. Above 90 percent, the multiplier turns negative. The model case-study for this phenomenon has been Japan. During the 30-year period from 1990 through 2020, Japan experienced persistent negative GDP growth and deflation as their debt-to-GDP ratio grew from less than 90 percent in the late-1980’s to nearly 300% today. So, at a debt-to-GDP ratio of 122%, is the U.S. already on the road to perdition? Perhaps.

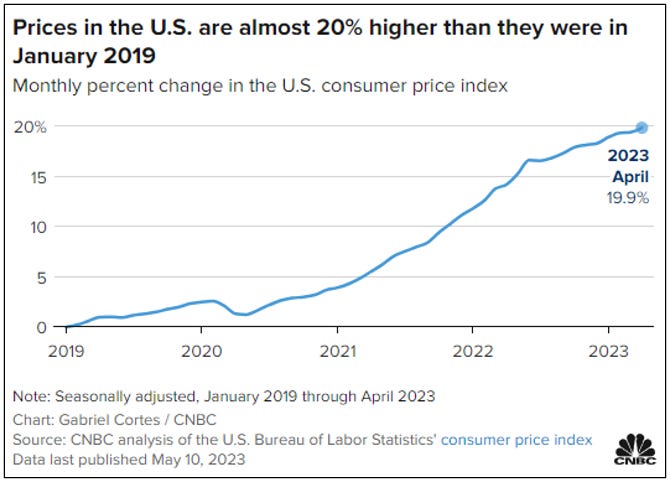

According to a new report published by Lending Club, 61% of the 1,600 adults who participated in a nationwide U.S. survey conducted in July said that they are still living paycheck-to-paycheck. That’s up slightly from 59% a year ago. Importantly, while the headline inflation rate has declined over the past year, consumer prices on balance are now approximately 20% above their pre-COVID levels on average. One reason why credit card and auto loan delinquencies are on the rise is that middle-class workers are simply tapped out. According to the Congressional Budget Office (CBO), even though middle-class wage growth is high today by historical standards, it isn’t keeping up with the increased cost of living. Indeed, real wages for this cohort have declined since 2019. Moreover, the median income in the U.S. — now about $36K, has grown by a mere 12.5% since start of the new century.

The federal government is in the same boat. Annual tax receipts are declining in both nominal and real terms. Again, according to the CBO, the U.S. federal budget is expected to remain in a state of deficit over the next decade. That deficit is forecast to expand from about -$1.5 trillion this year (5.5% of GDP), to more than -$2.8 trillion annually by 2033 (7.3% of GDP). Over this period, the national debt is expected to grow from $32.8 trillion this year to approximately $53 trillion by 2033. If GDP growth meets expectations, then the nation’s debt-to-GDP ratio will exceed 135% by the end of the decade. This is the reality of which we spoke. This is water.

Rising Yields Could Push Banks to a Tipping Point

What are the long-term implications of all of this deficit spending for Treasury yields? If the CBO’s estimates prove correct, then the world will need to absorb nearly two-thirds of the nominal value of our current national debt over the next 10-years. It is unlikely to do so without some yield incentives. We presented the chart above last month. It’s a monthly point & figure analysis of the 10-year U.S. Treasury yield, which uses the three-box reversal method to project future price targets. The breakout above 3.0% — clearing the downtrend off the 1981 high, projects an eventual upside move to 10.63%. Louise Yamada is a former colleague from our Citigroup days with whom we keep in touch. Louise was perennially ranked as the #1 Technical Analyst on Wall Street in the annual Institutional Investor poll. Her preference for focusing on long-term structural trends has had an important influence on our approach to technical analysis. In a recent exchange, we asked Louise what she thought about the chart and the probability that the implied 10.63% price target would be achieved. She responded,