Please enjoy the free portion of this monthly investment newsletter with our compliments. To get full access, you may want to consider an upgrade to paid for as little as $15/month. As an added bonus, paid subscribers also receive our weekly ALPHA INSIGHTS: Idea Generator Lab report, an institutional publication that provides updated market analysis and details our top actionable ETF idea every Wednesday. Thanks for your interest in our work!

Executive Summary

Back to the Future

Macro Perspectives: Risky Business

Geopolitics: Apocalypse Now

Market Analysis & Outlook: Die Hard

Conclusions & Positioning: The Right Stuff

Back to the Future

There are over 10,000 stocks in the United States, but only about 100 of them are leading the major averages higher — mainly those that make up the Nasdaq 100. It’s as though the stock market is 100 stocks and the other 9900 just don’t seem to matter much. Within the S&P 500, 48% of issues are underperforming the benchmark index year-to-date, while 40% are in negative territory for the year. Moreover, a full one-third of issues are negative for the trailing 12-month period. Meanwhile, Warren Buffett’s Berkshire Hathaway is now sitting on nearly $350 billion in cash. That equates to 5% of the U.S. Treasury bills outstanding today.

Some have posited that Buffett is just clearing the decks at Berkshire Hathaway in order to give his successor, Greg Abel, a clean slate from which to map out the company’s future. But, we doubt that Buffett would hold so much cash (a record 27% of assets) if he thought that there was big money to be made in stocks. The S&P 500 is currently valued at 23x the consensus 2025 EPS estimate ($261 according to S&P Global), while the total market-cap of the U.S. stock market is now 200% of GDP — a near record high for Buffett’s favorite valuation measure. The fact of the matter is that the U.S. stock market is richly valued regardless of which metric one favors most.

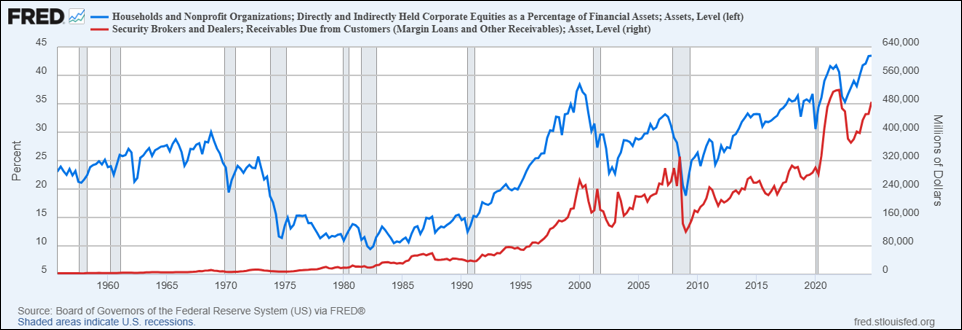

With margin debt and household ownership of stocks as a percentage of total assets near the highest levels on record, this condition puts equity investors at extreme risk should an exogenous shock to the system result in a major re-rating of valuations. Indeed, there are any number of potential exogenous shocks that appear possible on the economic front, including a long and protracted trade war for one, thus leading to inflation, and a likely recession if the latest Beige Book report is to be believed. There is also the possibility for a stalemate in Congress over the “One Big Beautiful Bill.” A sunset of the 2017 corporate tax rate provision would result in a sharp downward revision to EPS estimates for both 2025 and 2026. Then there is the alarming fiscal budget deficit (6.2% of GDP) and the ever-growing national debt to consider, and its implications for long-term interest rates.

But what if it’s something that is not on anyone’s BINGO card? A complete surprise. A bolt from the blue. A black swan, so-to-speak. Not to appear hyperbolic, but many contemporary thinkers foresee a potential worldwide collapse resulting from such catastrophes as nuclear war, resource depletion, climate change, or socio-political disintegration. Add to this the possibility that the evolution of AI and quantum computing may have material undesirable effects on society that are quite the opposite of those which are currently widely discussed — such as detailed in Issue #34. This is not a doomsday prediction, but the past five years have certainly given us all plenty of reasons not to doubt the notion that anything is possible — including the aforementioned extremes — no matter how unrealistic or improbable one might consider them to be.

It is estimated that 2,000 years ago the population of the world was approximately 300 million. It took more than 1,600 years for the world population to double to 600 million, and since then the growth has accelerated. It reached 1 billion in 1804, 2 billion in 1927 (123 years later), 3 billion in 1960 (33 years later), 4 billion in 1974 (14 years later), 5 billion in 1987 (13 years later), 6 billion in 1999 (12 years later), 7 billion in 2011 (11.5 years later), and 8 billion in 2022 (11 years later). Using the current rate-of-change, the world population should hit 9 billion in 2033 (although the United Nations currently forecasts it to arrive in 2037 — down from an estimate of 2042 back in June 2011). In short, the world population will have tripled in less than 80 years!

In October 1993, representatives of national academies of sciences throughout the world met in New Delhi at the “Science Summit” on world population. The participants issued a statement, signed by 58 academies:

“In our judgement, humanity’s ability to deal successfully with its social, economic, and environmental problems will require the achievement of zero population growth within the lifetime of our children…Humanity is approaching a crisis point with respect to the interlocking issues of population, environment, and development because the Earth is finite…Overpopulation of the world is contributing to major environmental trauma including deforestation, global warming, acid rain, and the pollution of air and water.”

There are many documented cases of irreversible damage to ecosystems, global weather system perturbations, as well as increasing concerns about a severe shortage of water. It is estimated that by the end of this year, two-thirds of the world population will live in water-stressed conditions. These problems all have one common root cause: human population growth and its associated economic development. Dr. Warren M. Hern, from the University of Colorado at Boulder has gone as far as to compare the human species with cancer. According to Dr. Hern, the sum of human activities, viewed over the past tens of thousands of years, exhibits all of the four major characteristics of a malignant process: 1) rapid uncontrolled growth; 2) invasion and destruction of adjacent tissues (ecosystems); 3) metastasis (colonization and urbanization); and 4) dedifferentiation (loss of distinctiveness in individual components as well as communities throughout the planet).

Dating back to 1798, when economist Thomas Malthus published his seminal book, An Essay on the Principle of Population, scientists have long worried about human population size and growth. Associated with the predicted crises of overpopulation, possible scenarios today involve a systematic development of terrorism and the segregation of people into two groups: a minority of wealthy communities hiding behind fortress walls from the crowd of “have-nots” roaming outside. This could occur both within developed countries, as well as between them and developing countries. Politics aside, it’s already begun if one considers the nation’s current immigration policy from this perspective.

History tells us that civilizations are fragile, impermanent things. Our present civilization is a relative newcomer, succeeding many others that have died. The fall of the Roman Empire is the most widely known instance of collapse, as detailed in Issue #26. Yet, it’s only one case of a common process. Collapse is a recurrent feature of human societies. The archeological and historical record is replete with evidence for prehistoric, ancient, and pre-modern societal collapses. These collapses all occurred quite suddenly, and frequently involved regional abandonment, replacement of one subsistence base by another (such as agriculture by pastoralism), or conversion to a lower hierarchy of socio-political organization (such as local from interregional).

Human history as a whole has been characterized by a seemingly inexorable trend toward higher levels of complexity, specialization, and socio-political control, thus leading to the processing of greater quantities of energy and information, the formation of ever larger cities, and the development of more complex and capable technologies. There is a growing body of research suggesting that the complexity caused by high technology could be humankind’s undoing.

For example, the Maya of the southern Peten lowlands dominated Central America up to the ninth century. They built elaborate irrigation systems to support their booming population, which was concentrated in cities that grew in size and power, with temples and palaces built and elaborately decorated, flourishing culture and arts, and the landscape modified and claimed for planting. Overpopulation and over-reliance on irrigation was a major factor in making the Maya vulnerable to failure. The trigger event of their collapse appears to have been a long and severe drought beginning around 840 A.D. There are many examples of civilizations that became vulnerable to environmental stress due to climate change including the Akkadian empire in Mesopotamia, the Old Kingdom of Egypt, the Indus Valley civilization in India, as well as early societies in Palestine, Greece, and Crete that all collapsed from a catastrophic drought between 2300 and 2200 B.C.

Notwithstanding war and plagues, among the many factors that contributed to the collapses of numerous ancient societies, there seem to be two main causes: too many people and too little fresh water. Modern paleoclimatic data that provide an independent measure of the timing, amplitude, and duration of past climate events, shows that the climate during the past 11,000 years has been punctuated by many climatic instabilities. Multidecadal to multicentury-length droughts started abruptly, were unprecedented in the experience of the existing civilizations, and were highly disruptive to their agricultural foundations, leading to societal collapse.

It is tempting to believe that modern civilization, with its scientific and technological capacity, its energy resources, and its knowledge of economics and history, should be able to survive whatever crises ancient and simpler societies found insurmountable. But how firm should this belief be in view of the fact that our modern civilization has achieved the highest level of complexity known to humanity? This complexity comes with a high differentiation of human activities, a strong interdependence, and reliance on environmental resources to feed concentrated populations. These ingredients seem to have been the roots of collapse for many previously great civilizations. Many of today’s optimistic investor class believe that the acceleration of innovations is the solution to avoiding the dead-ends confronted by previous civilizations. But in our view, we are underestimating the potential for the acceleration of innovation to make us more vulnerable to failure.

For example, our dependence upon electricity for nearly everything should be understood to be our civilization’s biggest vulnerability. This was confirmed when both Spain and Portugal experienced nationwide power outages on April 28th, which lasted nearly 18 hours. The outage was one of the worst ever in post-WWII Europe and affected tens of millions of people, resulting in at least seven deaths, and disrupting businesses, hospitals, transit systems, cellular networks, and other critical infrastructure across the Iberian Peninsula. It is unclear as to what triggered the blackout, but authorities are blaming the region’s unstable electric grid.

According to Grazia Todeschini, an engineering researcher at King’s College London, “Electrical grids are large interconnected systems, and their stability is related to a very close balance between electricity generation and demand.” Increasing demand for electricity from data centers to power the large language models that make Gen-AI possible is likely to far outstrip increases in power generation capacity over the next 12-24 months. In our view, given the antiquated condition of the electrical grid across North America, this represents a material risk to western civilization.

To be sure, in February 2021, the state of Texas suffered a major power crisis, which came about during three severe winter storms sweeping across the United States between February 10th and February 20th of that year. The storms triggered the worst energy infrastructure failure in Texas state history, leading to shortages of water, food, and heat. More than 4.5 million homes and businesses were left without power — some for several days. At least 246 people were killed as a direct or indirect result of the crisis. Damages due to the cold wave and winter storm were estimated to be at least $195 billion, and was likely the most expensive disaster in the state’s history. According to the Electric Reliability Council of Texas, the Texas power grid was four minutes and 37 seconds away from complete failure when partial grid shutdowns were implemented.

Another recent example occurred on August 14, 2003, when a total blackout followed a widespread power outage throughout parts of the Northeastern and Midwestern United States, and most parts of the Canadian province of Ontario affecting an estimated 55 million people. Most places saw power restored within 7 hours — some as early as within 2 hours. But, full power wasn’t restored to New York City and parts of Toronto until August 16th. At the time, it was the world’s second most widespread blackout in history, after the 1999 Southern Brazil blackout, and was much more widespread than the Northeast blackout of 1965. It’s proximate cause was determined to be a software bug in the alarm system at the control room of FirstEnergy, which rendered operators unaware of the need to redistribute load after overloaded transmission lines drooped into foliage.

Again, this is not a doomsday prediction, but if you don’t own a standby generator, then it’s time to take action! The writer-philosopher George Santayana wrote, “Those who cannot remember the past are condemned to repeat it.” We present the ideas above not to frighten or alarm our readers, but to challenge them to think about the risks going forward, in order to prepare themselves for all possible outcomes — not just the Panglossian views portrayed in the financial media day after day. President Trump recently paid homage to his good friend Xi Jinping, stating, “he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” That’s putting it mildly in our view. The last time Trump tried to make a deal with Xi, the Chinese President responded by accidentally releasing a biological weapon upon the world. To be clear, this is just the world in which we live. “Accidents” can, and do happen. Perhaps this time Xi will accidently attach an EMP to a “weather balloon” and detonate it over Washington D.C. or New York City?! But we digress.

Below we’ll discuss why we think the risk of recession is much higher than most believe it to be. We will also discuss why we think consensus forward earnings estimates are completely unrealistic, and destined to be revised materially lower. In addition, we’ll examine recent geopolitical events and their implications for continued heightened risk of global instability. Finally, we present our comprehensive analysis of equity markets, commodities, currencies, crypto, and rates, then review our “Perfect Portfolio” asset allocation strategy (+8.2% year-to-date through 5/31/25), which details how we believe investors should be positioned today in order to thrive during what promises to be a period of sustained volatility in the months immediately ahead.

Let’s begin…