Please enjoy the free portion of this monthly newsletter with our compliments. To get full access, you might want to consider an upgrade to paid for as little as $15/month. As an added bonus, paid subscribers also receive our weekly ALPHA INSIGHTS: Idea Generator Lab publication, which details our top actionable trade idea and provides updated market analysis every Wednesday, as well as other random perks, including periodic ALPHA INSIGHTS: Interim Bulletin reports and exclusive video content.

Executive Summary

The Problems With Blind Optimism

A Gambler’s Guide to the Stock Market

Geopolitical Perspectives: The Indo-Pacific Powderkeg

Market Analysis & Outlook: The Real Bull Market

Conclusions & Positioning: Mining for Returns

The Problems With Blind Optimism

When investors collectively view the world through rose colored glasses, it typically results in wild ideas with endless possibilities for the future of mankind. Optimism overwhelms reason, and investors stop asking why, and instead begin asking why not? The actions of a few imaginative thinkers are dubbed a new age of innovation and suddenly every advance in technology is immediately extrapolated to its logical conclusion with blind optimism. Examples today abound: Robotaxis, the metaverse, AI, and the colonization of Mars all come to mind. What’s next, time travel?

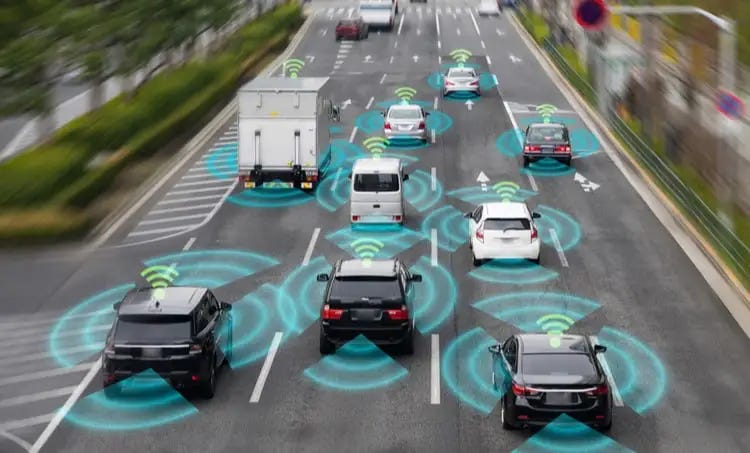

The first problem with blind optimism is that it fails to recognize the limitations to success. The electric car actually debuted in the U.S. 135 years ago back in 1889. No doubt, there have been tremendous advances in electric vehicles since the Tesla Roadster was first introduced in 2008, to the point today where EVs now represent 18% of all new automobiles sold globally. That said, it would be a monumental leap to assume that mass-produced EVs with limited-range batteries, coupled with autonomous vehicle technology that has only proven successful when used in controlled environments, will soon evolve into a national fleet of “Johnny Cabs” — a la Total Recall. Yet, financial commentators and media pundits are giddy about the promise of a new age of driverless electric cars and robotaxis — to the delight of Elon Musk, who provokes the dialog every chance he gets. Investors, on the other hand, have apparently moved on, leaving Tesla’s stock price some 57% below its November 2021 all-time high of $414.50.

Artificial Intelligence (AI) is what investors now crave — nevermind the fact that no such thing yet exists. Indeed, what passes for AI today is nothing more than a chatbot with some clever programming. Chatbots do not possess any intelligence whatsoever. As we detailed in Issue #22, a chatbot is just a recursive algorithm with data parsing and classification abilities — only slightly more advanced than IBM’s “Watson” of Jeopardy fame circa 2011 — and that, thanks only to the use of new high-powered GPUs produced by Nvidia, whose stock price has quadrupled over the past 13-months. With respect to genuine AI, Max Tegmark, a machine-learning researcher and professor at MIT, thinks there will be no debate about its existence if and when it does come to fruition. As the President of the Future of Life Institute, he led an unsuccessful call last year for a six-month pause in advanced AI research. Why? Because in Tegmark’s view:

“The risk is that when AI actually does manifest, the human race may be in a fight for its very survival as a species within days.”

And therein lies the second problem with blind optimism: it fails to recognize the risks of success.

The Centre for the Study of Existential Risk at Cambridge University regards AI to be the single greatest threat to humanity. They are not alone. In May 2023, the Center for AI Safety issued a one-sentence statement:

“Mitigating the risk of extinction from A.I. should be a global priority alongside other societal-scale risks, such as pandemics and nuclear war.”

The statement was signed by many key players in the field, including the leaders of OpenAI, Google and Anthropic, as well as two of the so-called “godfathers” of AI: Geoffrey Hinton and Yoshua Bengio. How could such existential fears be played out you ask?

One famous scenario is the “paperclip maximizer” thought experiment articulated by Oxford philosopher Nick Bostrom. The idea is that an AI system tasked with producing as many paper clips as possible might go to extraordinary lengths to find raw materials, like destroying factories and causing car accidents. A less resource-intensive variation has an AI system tasked with procuring a reservation to a popular restaurant shutting down cellular networks and traffic lights in order to prevent other patrons from getting a table. Whether it’s office supplies or dinner, the basic idea is the same: AI, if it ever came into existence, would be a sort of advanced alien intelligence that might be extraordinarily effective at accomplishing specific tasks or objectives, but dangerous because it doesn’t have a moral compass and lacks common sense. In its most extreme version, this argument morphs into explicit anxieties about AI enslaving or destroying the human race to achieve said objectives. There’s a scene from the movie The Terminator that comes to mind, where Kyle Reese tries to explain the machine to Sarah Connor:

“It can’t be bargained with. It can’t be reasoned with. It doesn’t feel pity, or remorse, or fear. And it absolutely will not stop — ever!”

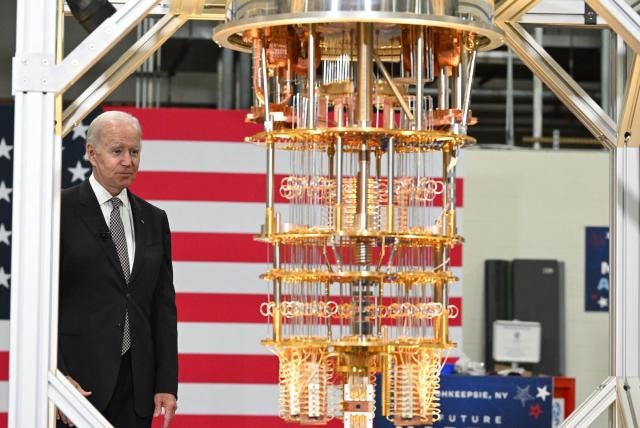

But let’s assume that genuine AI never comes to fruition — that cooler heads prevail, and the powers that be prevent or contain any potential existential threat from AI. Is the coast then clear? Unfortunately not. There is another threat of potentially even greater risk to the current world order: quantum computing. If you don’t know what that is, you’re in good company — almost nobody does. As such, few people fear it. Conventional computing is founded on bits, a series of binary switches that are either on or off, 1 or 0. Quantum computers use qubits, which can represent the sequences 1-0, 1-1, 0-1 and 0-0 simultaneously. The potential is huge because quantum computers can process instantaneously in parallel. They can perform tasks in a few minutes that would take conventional computers millions of years to complete.

Quantum computing is not an intelligence, but a brute force of trial and error at warp speed. The potential applications for such power are mind-boggling with respect to the impact on scientific research, meteorology, financial modeling, and new drug discovery, just to name a few examples. Yet, the list of nefarious endeavors is equally long. Quantum computing has the power to crack codes and passwords, thus compromising bank accounts, medical records, personal data, the social security and medicare systems, and perhaps even trigger a nuclear strike. A quantum computer would have the ability to run through an almost infinite number of possible fingerprints or retina patterns in just a few seconds. As such, how will it be possible to secure data stored on any networked device? Quantum computing could undermine the very foundations of civilization.

From a national security perspective, the only thing scarier than having quantum computing power is not having it. As such, the U.S. National Quantum Initiative advisory committee reports directly to the White House. While the quantum computing landscape is teeming with innovative startups, several industry giants have established themselves as the pioneers in this space including IBM, Google’s Quantum AI, Amazon, Microsoft, and Intel. Quantum computing is still in its infancy, with many questions yet to be answered. However, the rapid advancements in the field, coupled with the significant investments flowing into the space, are a testament to the technology's potential. While there's still a long road ahead, the progress made to date suggests that it has potential to solve some of the world's most complex challenges, as well as create others that we have yet to even conceived of.

One final problem that arises from succumbing to blind optimism is that it sometimes pays out quick dividends — at first, which tends to act as a gravitational force that pulls society further away from the path of reason. One need look no further than the online gambling industry to see state of social dysfunction that exists in our civilization today as a result. Some might argue that “games of chance” are as old as time itself, but never before could an 18-year old student gamble away his college tuition money on a football game from the comfort of his dorm room faster than he can today. Based upon our own personal observations, discussions with a few concerned parents of young adults, and some young adults themselves, we are convinced that there is a rapidly advancing addiction to gambling in this country — and for that matter, the world — that is every bit as dangerous from an economic perspective, as opioids are from a health perspective. Note the disclaimers at the bottom of the Draft Kings advertisement below.

We’re not talking about placing an inconsequential side bet on the Super Bowl, or making a golf match interesting among friends. Blind optimism has convinced an entire generation to throw caution to the wind without any consideration of the consequences — and not just at the casino. This addiction to gambling now affects the decisions of young adults related to career, household formation, and asset accumulation and allocation. “You only live once” — YOLO — is the battle cry of today’s youth. According the Center for Gambling Studies at Rutgers University, addiction to gambling has resulted in a dramatic rise in the incidence of suicide and depression among young adults caught in its web. The failure of blind optimism in the pursuit of longshots has led 1-in-6 men of prime working age to give up. According to Nicholas Eberstadt, the Henry Wendt Chair in Political Economy at the American Enterprise Institute, and author of Men Without Work: America’s Invisible Crisis, more than 10 million men between the ages of 24 and 44 are currently living under a parent’s roof, or on some form of public assistance. Presumably, they’ve all decided to spend the rest of their days in the metaverse, or perhaps they’re just waiting for the bus to Mars.

A Gambler’s Guide to the Stock Market

Like most people, we find the stock market to be utterly fascinating. The market’s potential for bountiful gains — made even more attractive by the gamification of internet stock trading, resonates with the gambler in all of us. However, the stock market is not meant to be a casino. It’s designed to be a vehicle of fluid exchanges, allowing the efficient function of capitalistic, competitive free markets. Yet, according to research produced by Professors Federico Bandi and Nicola Fusari at Johns Hopkins’ Carey Business School, within the S&P 500, daily transaction volume in so-called “Zero Days to Expiration” options (0DTE) averaged 43% of overall daily option volume during 2023. That’s more than double the volume attributable to 0DTE options in 2021. Courtesy of BofA Global Research, the chart below illustrates that, as of April 2024, the number has grown to nearly half of daily option volume.

Moreover, the estimated daily notional value of 0DTE options now approximates $1 trillion, according to TipRanks. Derivatives were initially devised as a mechanism to hedge against market volatility. While sophisticated market players, including hedge funds and banks, employ short-dated options to manage risk on a day-to-day basis, for some retail investors, trading in these short-lived contracts is perceived to be a way to ride sharp intraday moves and a path to potential riches. As such, it would appear that gambling has now officially infected the stock market. What are the implications of this development? In some quarters of Wall Street, it is believed that extreme market moves could be caused by the sudden intraday volume shifts in options. This, in turn, could lead to major market ripples. We’ll know more about that in the fullness of time.

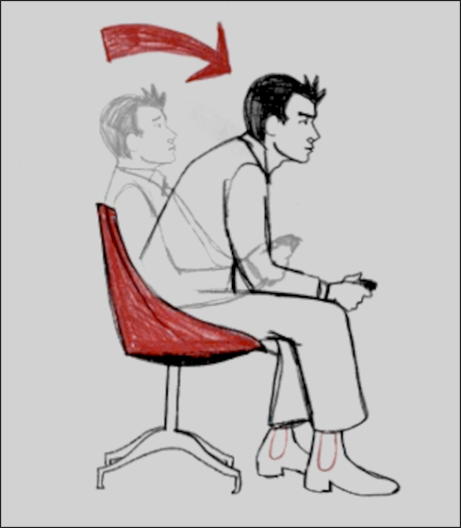

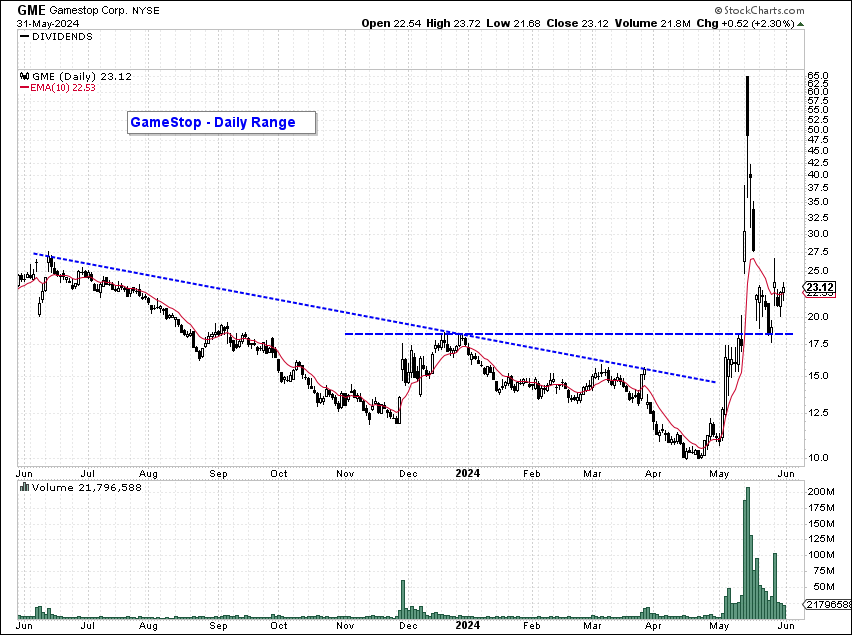

Gambling on so-called “meme stocks” suddenly came back into fashion last month following the first online post from Keith Gill in almost three years. On May 12th, Gill, who goes by the handle “@TheRoaringKitty” on Twitter/X, and is also known in some Reddit circles under the handle “DeepF#@%ingValue,” posted to his previously dormant Twitter account the image of a video gamer sitting forward on their chair — a meme used by gamers to indicate they are taking the game seriously. It received 27 million views. Shares of video game retailer GameStop (GME) nearly quadrupled over the subsequent two trading sessions. But the excitement was short-lived as sellers hit the bid — quickly driving the stock price back down from an intraday high of $65 to the $17.50 level from which the surge began. Gill followed up with a series of posts of short videos from popular TV shows and movies, although the meaning behind them was unclear. He has since signed off again. Recall that Gill was the subject of regulatory and congressional scrutiny following his bullish public posts about GME on the Reddit thread WallStreetBets. He is considered to be directly responsible for the failure of Melvin Capital Management, the hedge fund run by former SAC trader Gabe Plotkin, which was caught in a “short squeeze” related to its bearish position in GME. The story is detailed in the biographical comedy/dramatic film, Dumb Money.

To the credit of management, GME used the renewed investor interest in its stock to complete a $900 million secondary equity offering last week, which should help keep the withering business afloat for a while longer. The #2 meme stock, AMC, saw its shares triple during the wild trading sessions that followed Gill’s post. The movie theater chain also took advantage of the opportunity — using it to raise about $250 million of new equity capital. Those were savvy moves, no doubt, but the buyers that just got trapped at prices that are 2-3x above the current share price want only one thing now — to get even and get out!

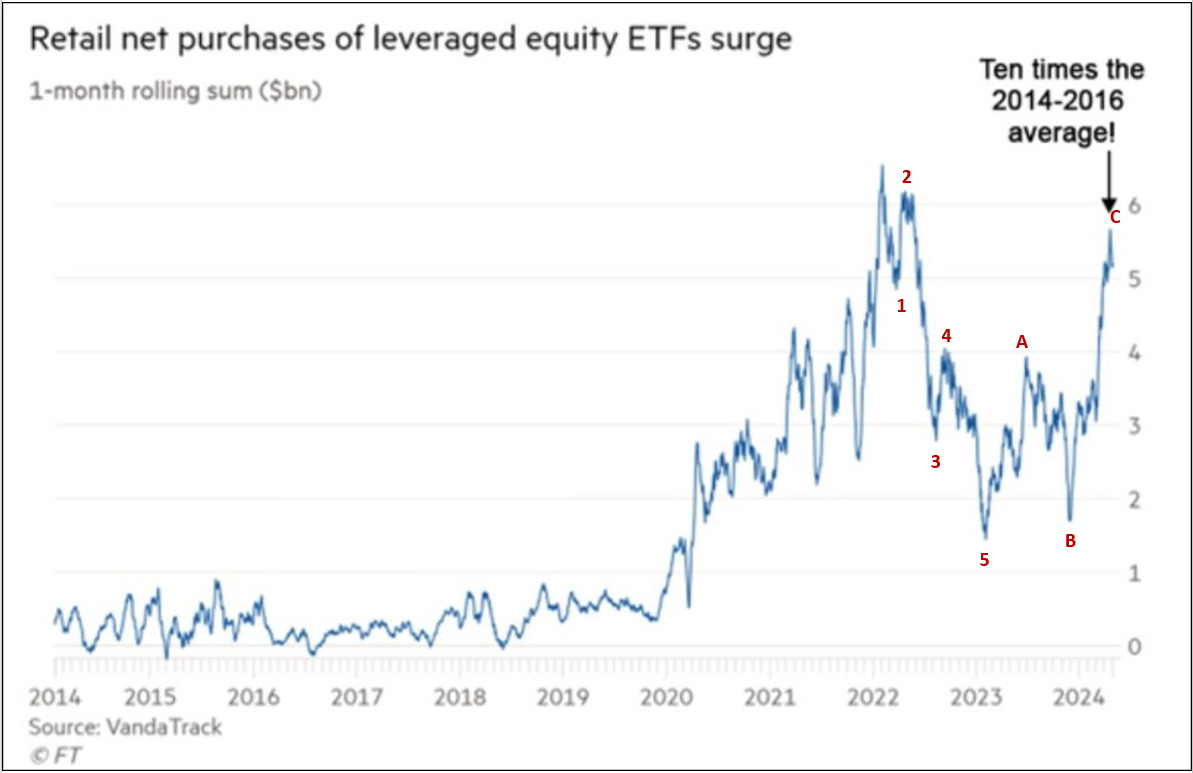

Still not convinced that the lunatics are running the asylum? Then consider this: The 1-month rolling sum of retail net purchases of leveraged equity ETFs surged to nearly $6 billion as of mid-May. That equates to ten times the average between 2014-2016, and is just shy of the all-time record high that was achieved in November 2021, and challenged again in January 2022. A leveraged equity ETF is a derivative that represents the daily price change in an underlying index or security, multiplied by its leverage factor. As with all options, leverage can dramatically exaggerate daily price moves in both directions, but in range bound markets it can quickly erode the principal value of the investment. The current long positioning around leveraged ETFs implies an extreme in optimism toward stocks. The advance off the 2023 low has traced out a discernible three wave pattern [A-B-C], which appears to us to be countertrend to the five wave decline [1-2-3-4-5] that preceded it — known in Elliott Wave parlance as an impulse pattern. An impulse wave moves in the direction of the primary trend. In our opinion, this measure may have already topped, and appears poised for the next impulsive move to the downside to ensue. We expect it to revisit its 2014-2016 average before the next bear market decline in the stock market concludes.

Retail investors have piled into unlevered equity funds this year as well. The 21-DMA of daily net inflows by individual investors into U.S. equity mutual funds reached a new all-time record high this past month — exceeding $1.5 billion. There can be no doubt about the attitude of retail investors toward stocks — actions speak louder than words. And these actions suggest that retail is all in!

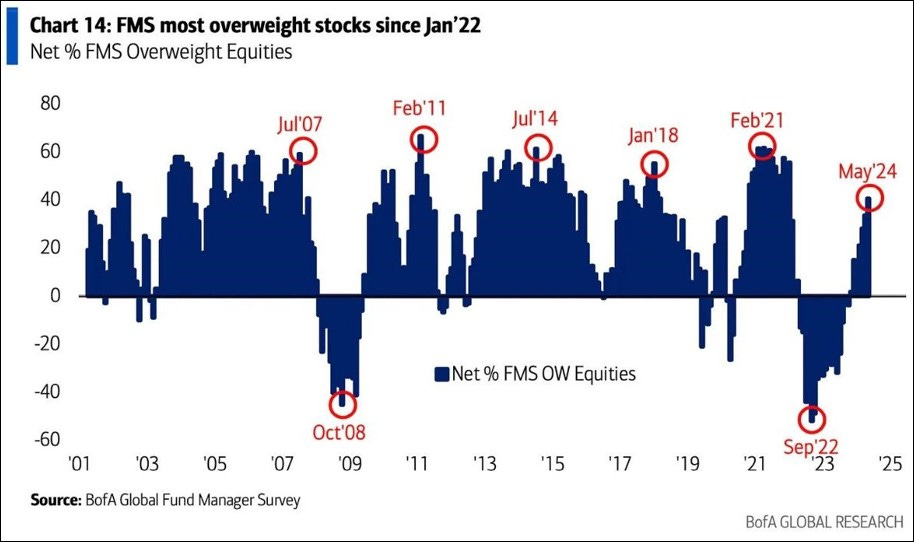

But retail investors are not alone in their optimism. Professional fund managers are currently the most overweight equities that they’ve been since January 2022, at the height of the last market top. A recent report published by Goldman Sachs’ prime brokerage division stated that the Magnificent 7 stocks (MSFT, NVDA, AAPL, GOOG, AMZN, META, and TSLA) now account for approximately 20.7% of hedge funds’ total U.S. single stock net equity exposure — the highest level on record.

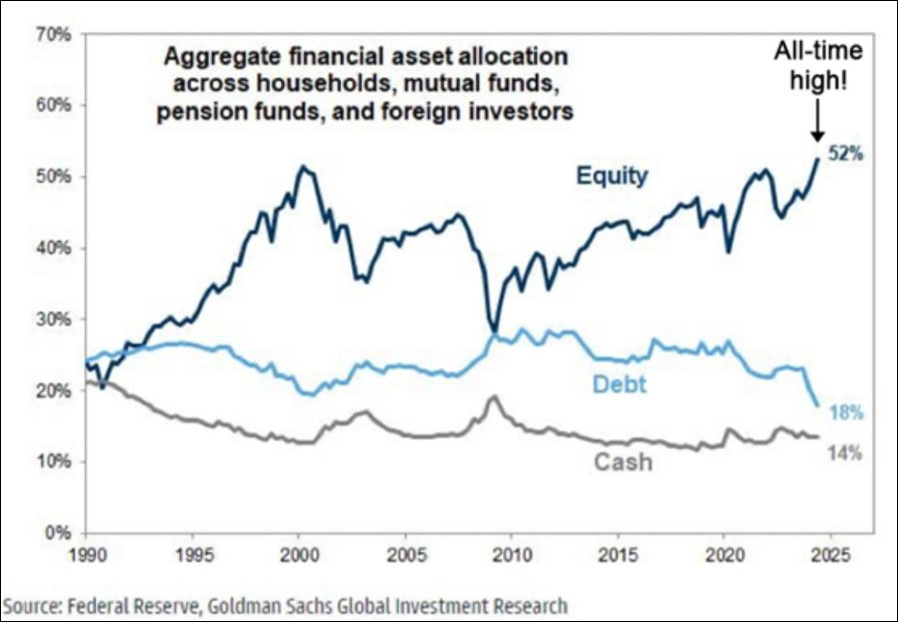

Indeed, global equity allocations across all investor cohorts have now reached 52% — an all-time record high that exceeds both the 2022 peak, and the Dot-Com mania peak in March 2000. Fixed-Income allocations, on the other hand, have fallen to 18% — a 34-year low. Meanwhile, cash allocations are bouncing along the bottom — near record lows at just 14% — despite the highest short-term yields in over a decade.

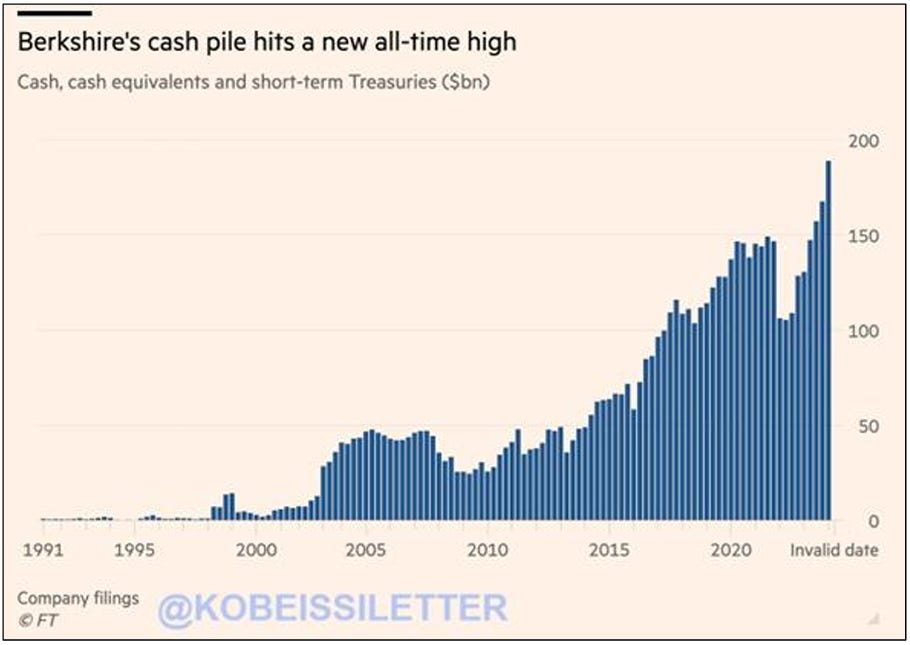

There is, however, one notable investor who is bucking this trend. Warren Buffett looked tired and appeared a little slower than usual at this year’s Berkshire Hathaway annual shareholders meeting, but then again he is 93 years old. That being said, his mind is as sharp as ever and his explanation for the $19 billion increase in the company’s cash hoard was simple: He can’t find anything compelling enough to buy.

“I don’t mind at all, given current conditions, building our cash position,” said the Oracle of Omaha, “Sometimes no investment is the best investment.”

Berkshire’s current cash position of $189 billion now exceeds the combined market-cap of both Starbucks and Target Corp. Berkshire also sold 13% of its stake in Apple during the first quarter, and slowed its share buyback by 50% Q/Q in favor of cash.

The Dutch scholar and theologian Desiderius Erasmus of Rotterdam was considered to be one of the greatest thinkers of the Renaissance era. He was responsible for publishing an annotated collection of ancient Greek and Latin proverbs entitled, Adagia. From that collection, there is one ancient proverb that seems particularly apt today given the conditions described above that now proliferate:

“In the kingdom of the blind, the one-eyed man is king.”

Geopolitical Perspectives: Indo-Pacific Powderkeg

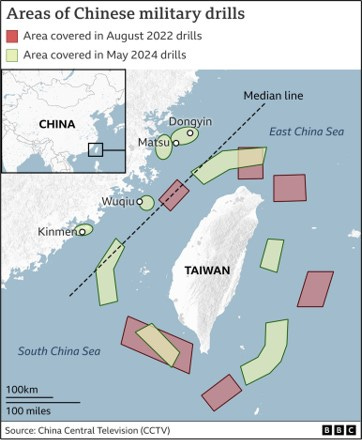

Things are heating up again between China and Taiwan. Beijing launched two days of military drills in the waters around Taiwan last Thursday in what it said was a “strong punishment” for “separatist acts” after the country’s newly sworn in president, Lai Ching-te, gave a fiery inauguration address in Taipei earlier that week to kick-off his four-year term. It was the third set of exercises encircling the island in the past two years. The U.S. State Department said on Saturday that the United States was "deeply concerned" over China's military drills in the Taiwan Strait and around Taiwan, and strongly urged it to act with restraint. The State Department issue the following official statement:

“Using a normal, routine, and democratic transition as an excuse for military provocations risks escalation and erodes long-standing norms that for decades have maintained peace and stability across the Taiwan Strait.”

China regards democratic Taiwan as part of its territory and has vowed to bring the island under its control, possibly by force, and U.S. intelligence believes that Xi Jinping has ordered the PLA to be ready to take the island by 2027. In the meantime, Taipei has had to react to a campaign of so-called “grey zone” activities including frequent cyber-attacks, regular incursions by military jets into its airspace, and harassment by Chinese vessels within its territorial waters. Taiwan’s military is vastly smaller than China’s, but it is protected by formidable mountainous terrain — and the treacherous 110-mile Taiwan Strait.

The Chinese navy already has the world’s biggest surface fleet, and it has also built dozens of dual-use vessels capable of acting during peacetime and in war. According to a recent article in the The Telegraph, a decade ago, Beijing issued technical guidelines for shipbuilders that would enable many of its civilian vessels to be suitable for military uses and is believed to have integrated its ferries, tankers and container ships within its military command structure, according to a report from the U.S. Naval War College’s China Maritime Studies Institute. Chinese state media has touted these efforts for years, regularly hailing the participation of ferries in cross-sea landing drills. CCTV praised the 135-meter Bang Chui Dao after it “joined the army” for military exercises in 2019, and the 164-meter Bohai Pearl in 2021, which Global Times, citing an anonymous Chinese military expert, said would make a good addition for “transporting troops on a large scale in amphibious landing missions.”

Tom Shugart, an analyst at the Center for a New American Security — a think tank, estimated in 2022 that China’s civilian vessels could dramatically increase the tonnage of military material that can be moved by its existing military amphibious assault craft, giving it capacity to transport about 300,000 troops and their vehicles across the Taiwan strait in about 10 days. He wrote at the time:

“Both the Taiwanese and American intelligence communities, should start watching China’s key civilian shipping in the same way they watch its naval vessels.”

As long time readers might suspect, we are not surprise by these developments. We began writing about the new “axis powers” more than two years ago following Russia’s invasion of Ukraine, and have touched on the subject in one way, shape, or form, in almost every issue since. In Issue #9, dated June 1, 2022, we had this to say about the matter: