Please enjoy the free portion of this monthly newsletter with our compliments. To get full access, you might want to consider an upgrade to paid. As an added bonus, paid subscribers also receive our weekly ALPHA INSIGHTS: Idea Generator Lab publication, which details our top actionable trade idea every Wednesday, as well as other random perks, including periodic Special Edition research reports and video content.

There’s an interesting, if not captivating story that can be heard echoing throughout financial media outlets these days. It goes something like this. “Unemployment is at a 50-year low and the consumer is in great shape. Inflation has peaked, and the Fed is going to pause — then pivot in the second half of the year, allowing the economy to avoid recession. The stock market had this all figured out on October 13th, when it made its bear market low, and we have since entered a new bull market.” Stay with us now, because the story gets better. “The Nasdaq 100 just posted its strongest January since 2001, and the S&P 500 penetrated its primary downtrend line and has now posted a daily, weekly, and monthly close above its 200-DMA.” Oh, and lest we forget, “ChatGPT is going to change the world. It’s the next big thing!”

All very exciting, to be sure. Indeed, the S&P 500 has rallied 7.8% YTD, definitively breaking out above an established descending trendline off the Jan-Aug 2022 highs, and discussions of “breakaway momentum” and “breadth thrusts” are proliferating around the Twittersphere. Meme stocks, crypto, and disruptive tech are leading the charge again this year. And one popular "contrarian" macro strategist, who predicted a “melt-up” going into 2022, has decided to double down going into 2023, now calling for a record breaking year for the S&P 500 with a target price of 6,000-7,000 for the benchmark index — by mid-Summer no less!

There is no doubt that the animal spirits of investors have been reawakened by the market's recent price action, as evidenced by the new 52-week high in the CNN Fear & Greed index, an intermediate-term gauge of investor and trader sentiment. The current reading of 76% tips the scale into the “extreme greed” zone. Given all of the excitement, how could anyone not be captivated by the possibility of getting back what they lost last year — just get even and get out, right? Can’t you just hear the prayers resounding across churches, synagogues, and mosques everywhere? “Please dear Lord, let the stock market rally continue until I get back to even. I promise that I will never do it again.”

Yes, that is what all bear market rallies accomplish. They reset the expectations, and imaginations, of both anxious speculators and worn-out investors. This is especially true of second wave countertrend moves. R.N. Elliott had this to say about the subject, "Second waves often retrace so much of the wave one decline that most of the losses experienced up to that point are recovered by the time it ends. At this point, investors are thoroughly convinced that the bull market is back to stay." Elliott further mused, "The final advancing waves within upward corrections in larger bear markets are just as dynamic as third waves within a motive wave form and can be mistaken for the start of a new upswing."

The purpose of our discussion herein is to attempt to answer this question: Has the stock market bottomed? There can be no argument that since the October low, the stock market has put in a bottom, but is it the bottom? Or is this just another countertrend advance within a larger degree bear market decline — a second wave even?

A Look at the Fundamentals

To answer this question, let us first examine the fundamentals. And what better place to begin than with the health of the economy.

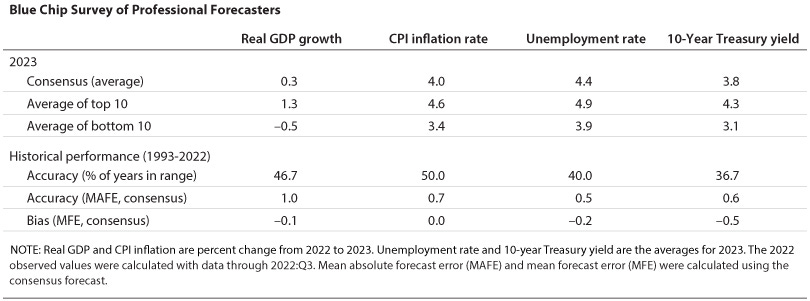

GDP growth collapsed in the first half of the 2022, posting two consecutive quarters of contracting real economic output: Final 1Q real GDP growth was -1.6%; and final 2Q real GDP growth was -0.6%. But, final 3Q real GDP growth came in surprisingly stronger that initially expected at +3.2%. The initial estimate for 4Q22 real GDP growth, reported at +2.9% by the BLS on January 26th, was equally surprising. Notwithstanding potential revisions, the current estimate puts actual 2022 Y/Y real GDP growth at just 1.0%. That’s down from 5.7% real GDP growth in 2021. Moreover, the consensus estimate for Y/Y real GDP growth in 2023, taken from the BlueChip Survey of Professional Forecasters, is now just 0.3%.

In our view, the consensus is still too optimistic. We expect the Fed to continue hiking their benchmark rate to at least 5.00%, and to hold at that level for the subsequent year due to persistent services inflation. The street agrees with our assessment, as the Fed Funds futures curve is now pricing in an 82.7% probability of another 25 bps rate hike at the March 22nd FOMC meeting. From there, the street expects the Fed to hold their benchmark policy rate at the 5.00% level through October. But that is where we part ways. The street sees the Fed cutting rates twice into year-end by a total of 50 bps. Our view is that the Fed will maintain a restrictive monetary policy stance until one of three things occurs: 1) the core inflation rate hits 2.0%; 2) the U-4 unemployment rate hits 5%; or 3) the U.S. economy spirals into recession.

While we do expect the U.S. economy to enter a recession before the end of the second quarter of this year, we don’t think that the Fed will take any monetary policy action without first receiving consent from the National Bureau of Economic Research (NBER). And we don’t think that the NBER will have enough data to call it a recession until early 2024 at the soonest. Here’s why. In order for the NBER to call a recession, a recession, they first need to see mass layoffs in the building and construction industry. But due to the expectation of large government contracts associated with the Infrastructure Investment and Jobs Act, construction companies are not laying off skilled labor positions. Instead they are accelerating completion of existing projects, in the absence of new projects, in hope of a windfall from government spending in late-2023. We think new infrastructure contracts will be delayed until 2024 as another government debt ceiling showdown looms ahead mid-year, and a resolution, while very likely, will not come without compromises.

Our qualitative research, which includes dozens of conversations with analysts, building contractors, skilled laborers, and other people of all walks of life, leads us to conclude that much of the economic strength witnessed in the back half of 2022 pulled-forward demand from 2023. Further, according to the Conference Board, a variety of trade and inventory adjustments appear to be masking GDP weakness in Q4. Indeed, it is well-understood in academic circles that the implementation of monetary policy changes works with a lag of approximately 6-12 months, leaving us 3-6 months away from impact. Case and point, Friday’s NFP report showed that 517K new jobs were created in January — more than double the number expected. It’s our view that the real economy will not begin to feel the true weight of this Fed’s restrictive policy shift until about mid-year 2023.

Said weight should result in a significant decline in aggregate demand in 2023, along with a continued decline in housing and construction activity, ultimately resulting in mass layoffs in the building and construction industry, coupled with continuing layoffs in technology, retail, and eventually hospitality, which should push the U-4 unemployment rate above 5.0% before year-end. At that point, we think the NBER will take notice, and the Fed will then feel that they have enough cover to risk another abrupt policy shift without having to face the blowback associated with pivoting too early, a la Arthur Burns in 1976-78.

Recession Indicators All Point to a Hard Landing

Why are we so dubious about the Fed’s ability to engineer a soft landing? We’ll to be kind, they don’t exactly have a stellar track record of success. Indeed, the Fed failed to avert recessions in 2020, 2008, 2001, 1992, 1980/81, and 1974. To put the task in perspective, the U.S. economy is an aircraft carrier, not a swift boat. It doesn’t turn on a dime. Not to belabor an earlier point, but the Fed doesn’t even know where they are in the process of slowing the economy because again, it takes 6-12 months before the effects of their policy changes become fully reflected in the data. In addition, the Fed is looking at lagging indicators, like inflation and unemployment — that are reported with a further lag, and revisions that come up to a year later. The Fed is then often delayed by up to an additional 30-days before the voting members of the FOMC even convene to discuss the latest data. Finally, the Fed’s decision making ability is further inhibited by “group think” and political ideologies, not to mention their own egos. All of this is working against their potential for success. Based upon these facts alone, the two occasions in which the Fed has been credited with successfully engineering a soft landing over the past five decades, 1985 and 1994, amount to little more than luck.

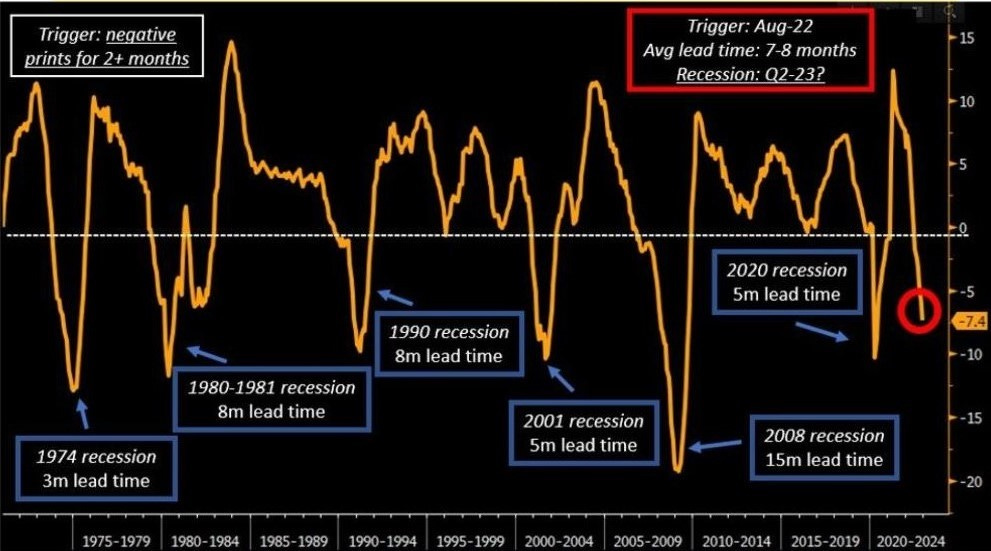

The Conference Board’s Top 10 Leading Indicator Index, illustrated in the chart above, has a 100% hit rate when it comes to anticipating recessions. The trigger occurs when the index turns negative for at least two consecutive months. This last occurred on August 22nd. Based upon data going back to 1970, the average lead time is approximately 7.5 months. Using history as our guide, and if past is prologue, then we should expect the U.S. economy to enter recession by 2Q23.

Housing activity is another window into the future of the the economy, and its relationship with financial markets. The NAHB index, a leading indicator of housing activity, has had an excellent track record of forecasting demand trends over the subsequent 12-months. As illustrated in the chart below, the correlation between the Y/Y change in the index and the annual return for the shares of United Parcel Service (UPS) — the largest delivery, transportation, and logistics company in the U.S. — have been astoundingly high over the past two decades. As housing goes, so goes UPS. As UPS goes, so goes aggregate demand.

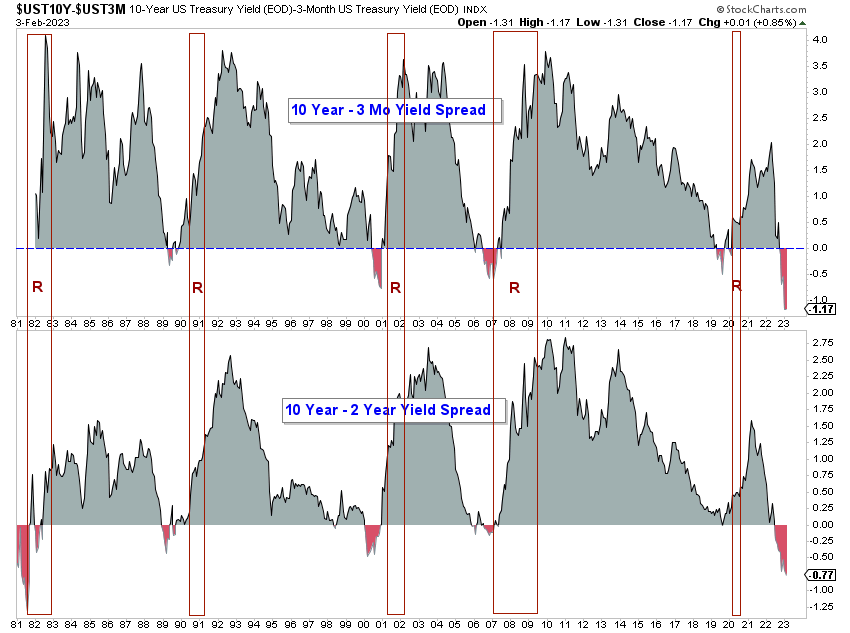

But, if you’re still in doubt, there is always the yield curve — aka, “old reliable.” An inversion in the 10 Year - 2 Year yield spread has preceded each and every U.S. economic recession over the last four decades. While the timing of said consequence has been know to follow with long and variable lags, ranging from 10 to 33 months, the current observed inversion of -77 bps, is the deepest since 1981. The recession that followed the 1981 episode was considered, at that time, to be the worst since the great depression. Fed officials often declare that the 10 Year - 3 Month yield spread is more meaningful. If that’s still true, then the Fed should be very concerned, because today’s -1.17% inversion is now the deepest on record. To quote my old colleague Harley Bassman, of Merrill Lynch fame — and creator of the MOVE index, “It’s a stone cold fact that the yield curve is the best predictor of a recession.”

Finally, let us address the elephant in the room — inflation. The bull case for a soft landing is hinged on the notion that inflation peaked last June and that the Fed’s efforts to vanquish inflation for good have been successful. We couldn’t agree more! Of course the Fed has conquered inflation. They raised their benchmark policy rate by 475 bps (effectively from zero) in less than one year. This has been the most restrictive monetary policy cycle in over 40-years. The question isn’t whether they’ve done enough. The question is whether they’ve done too much. In our judgement, they most likely have done too much. And the problem for the Fed is that they won’t know that until it’s too late.

For well-known reasons, that may now prove to be quite consequential, the Fed took action too late to quell excess demand when supply chains were tight, and bottlenecks were still being remedied. As a result, they allowed inflation to rear its ugly head. Then, in a fit of hubris, they had the audacity to toy with it. The escalation of rate hikes [25, 50, 75, 75, 75, 75, 50, 25] proves that the Fed had no clue what they were dealing with. Why institute a graduated scale of policy hikes when you’re already six months behind the curve? Did they just want to wound the beast? Inflation is not something to be trifled with — you shoot to kill!

The Fed has been watching the table below with great interest. But again, the data is lagging, and while they may think that core inflation is still running some 400 bps above target, it’s not. The last three months of data now have an annualized run rate of just 2.5%. Fed Chairman Jerome Powell used the word “disinflation” no fewer than a dozen times in his press conference last Wednesday. By the June FOMC meeting, we would not be surprised to hear the Fed Chairman use the word “deflation.”

Implication for Earnings and Valuations

Earnings estimates have been in a freefall since the end of the third quarter. The chart below illustrates how FTM S&P op-EPS estimates have come down from about $235 on September 30th, to just $224 today. Surprised? We aren’t either, but based upon how the S&P 500 has performed since mid-October, one has to wonder if the tail might be wagging the dog. Not only has the market’s FTM P/E multiple expanded by 3.5 turns, but HY credit spreads have tightened nearly 200 bps over the same period!

The market appears unphased by the risk of potential economic recession in the face of what is sure to be an earnings recession. Let’s do some math. S&P op-EPS came in at $208.53 in CY 2021. They’re expected to hit $219 for CY 2022. That’s up about 5% Y/Y. Bloomberg takes the average of several services to arrive at their Wall Street consensus estimate of $224 for CY 2023. That’s up about 2% Y/Y. Now, before we move on, let’s first consider that one year ago today, the consensus estimate for CY 2023 was $252, so it’s been revised down by about 11% over the last year. And as we’ve discussed ad nausium, at this point we’re still not even feeling the full weight the Fed’s restrictive policy experiment. So, when we suggest to you that the current Wall Street consensus estimate of $250 for CY 2024 is bunk, you can probably see our point. But if you still can’t, then consider that fact that the consensus CY 2024 estimate requires operating margins (the most mean-reverting series in finance) to expand back to peak levels of over 13%, despite being 300 bps above trend today!

The Wall Street consensus believes in the soft-landing scenario. It’s in their best interest to promote that story. That story leads to higher trading revenues. But the historical record suggests that when the ISM cycle is pointed hard down as it is today, then the [Earnings Estimate] Revisions index is set to follow in lock-step. Looking back at past ISM cycles since 1955, if we’re correct in our view that the economy enters recession this year, then the Revisions index has significant risk to the downside. According to Lance Roberts of Real Investment Advice, looking at data since 1920, the average earnings drawdown during past recessions is -30%. And if earnings do matter in the end, then so will valuations.

Total U.S. Market Cap-to-GDP closed the week at 158.4%, below the 2022 all-time record extreme of 209.4%, but still above its prior secular peak of 142.9% recorded in March of 2000. In addition, the Shiller cyclically-adjusted Price-to-Earnings ratio closed the week at 30.4x vs. its recent cycle high of 38.6x, and a historical average of 17.3x. The S&P 500’s Dividend Yield continues to plumb its historical lows, currently 1.64%, while its Price-to-Sales ratio is 2.4x, down from an all-time record high of 3.1x, but still above the March 2000 cycle extreme of 2.1x. Price to Book-Value is now 4.1x, below the 2000 peak of 5.0x, but more than double the 2009 trough of 1.7x. Looking back at history, the S&P 500 was cheaper than it is today more than 90% of the time.

Now back to the question at hand. Has the stock market bottomed? The answer will be known to all in the fullness of time, but until then, we can still look to history for some guidance.

The chart above compares our current predicament to the bear markets periods of 2007-2009 and 2000-2002, respectively. We think these are two reasonable analogs, but we would caution investors not to expect history to repeat itself with any degree of precision. Our first observation is that the 2022 bear market still appears to be early in its life cycle when compared to the other two completed bear markets. In addition, the recent challenge of the 200-DMA looks similar to the March 2002 challenge, before failing and plunging to new lows. It also looks similar to the December 2008 bear market rally in terms of its form. Notably, the current advance off the October 13th low is substantially shallower than both of the aforementioned bear market rallies.

Given the similarities between the current rally and the relevant historical bear market rallies, combined with the economic and fundamental backdrop discussed above, it seems improbable that the October 2022 low marked the bottom, but more likely will prove to be a bottom, of some degree of importance, within the context of a larger degree bear market decline.

Geopolitical Risks Remain Elevated

As detailed in past issues, we believe it’s plausible that China and Russia may have allied to undermine the West, each in an effort to achieve its own independent foreign policy objectives. We further believe that China may have supported Russia’s invasion of Ukraine in order to observe NATO’s response. China has since taken aggressive steps to insulate itself from any adverse repercussions should the same reaction befall it.

There is abundant evidence now that China is hoarding a 2-year supply of grain including more than half the world’s stores of wheat, corn, and rice. China has also assisted Russia in circumventing Western efforts to neutralize it’s fossil fuel economy, by tapping Russia’s excess capacity to build-up its own strategic petroleum reserve, potentially in advance of a planned military move against the sovereignty of Taiwan.

The Blackrock Geopolitical Risk Indicator tracks the relative frequency of brokerage reports and financial news stories associated with geopolitical risks. The indicator hit a new all-time high in December, exceeding the prior highs associated with Russia’s invasion of Ukraine by a wide margin. Much of this can be attributed to saber rattling by Chinese officials with respect to the reunification of Taiwan with China, following the re-election of Xi Jinping to an unprecedented third-term as President of the PRC.

Indeed, numerous U.S. military officials have come forward to declare the legitimacy of such a threat. The stakes are high, given the important role that Taiwan’s foundarys play in the production and supply of the world’s most technologically advanced semiconductor chips. The Center for Strategic International Studies recently published a 165-page report entitled, The First Battle of the Next War, which details their conclusions following a series of twenty-four war games that were conducted to determine whether China could succeed in reunifying Taiwan militarily.

In short, they found that China would be unsuccessful due to aggressive U.S. military intervention, but the damage was devastating. In all twenty-four scenarios, both sides took heavy losses. U.S. losses included over 400 military aircraft, its bases in Guam, and two Pacific Fleet carrier strike groups — the USS Nimitz and the USS Ronald Reagan — both of which were completely destroyed. The war games all make the assumption that the conflict does not escalate to the use of nuclear weapons, which the authors admit is an imponderable risk.

All of this raises some serious questions. Is China’s military up to the task? According to General Mark Milley, Chairman of the Joint Chiefs of Staff, China would not be ready militarily until at least 2027. Is the U.S. military up to the task? A classic line from the 1988 movie, Off Limits, probably sums it up best, “We are never outgunned.” Is the public up to the task? If a photo of a U.S. aircraft carrier, like one above, was ever broadcast on CNN, it would result in pandamonium. We don’t think the stock market would like one bit either.

Market Analysis and Outlook

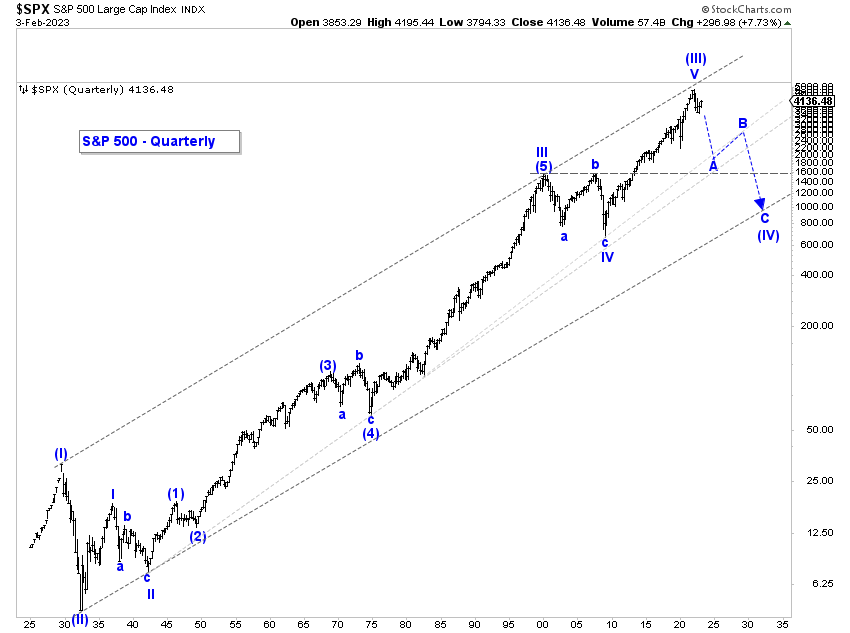

For some time now, we’ve been discussing the possibility that the January 2022 stock market peak terminated a 90-year Gann cycle that began off the 1932 low. This proposition dovetails well with the discovery made by R.N. Elliott that the stock market is a fractal, whereby a repeating pattern of progress (three steps forward, two steps back), can be observed at ever increasing degrees of trend. Elliott defined this pattern, referred to as the Elliott Wave model, as a motive wave form made up of five waves [1-2-3-4-5] followed by a corrective wave form made up of three waves [A-B-C], and deduced that the pattern itself derives from the nature of human social behavior.

It is with all of the above in mind that we ask you to remain objective as we zoom out, and delve a little deeper into our theory that the stock market may have completed what is known in Elliott Wave parlance as a supercycle degree advance. The chart below examines quarterly S&P 500 price data since 1926. We used quarterly DJIA price data since 1890 (not shown) to confirm that the supercycle wave (I) leg of this pattern meets the criteria to be considered a valid motive wave at supercycle degree of trend. Assuming that the 1929 high marked the top of supercycle wave (I), and the 1932 low marked the bottom of supercycle wave (II), then based upon the impulsive subdivisions of the subsequent motive wave at the same degree of trend, the market may have completed supercycle wave (III) in January of 2022. If our theory is correct, then that 90-year motive wave will be followed by a supercycle degree corrective wave form of like proportion.

That being said, markets can correct by going down sharply in price, by trading laterally in time, or by some combination of the two. There are eleven known corrective wave forms that have been documented over the past eight decades. The simplest is the zigzag, a straight-forward three wave declining pattern labeled [A-B-C]. The subwave sequence is 5-3-5, and the top of wave B is noticeably lower than the start of wave A. Waves A and C are often equal in length or magnitude. For purposes of discussion, this is the pattern that we have selected to illustrate the potential supercycle degree correction. It should not be interpreted as a precise forecast.

In addition, we cannot know for certain how long the corrective process will take. The Elliott Wave model has no hard and fast rules with respect to time, but as general guideline, Elliott did reflect that corrections had a tendency to take on a “proportional look” relative to the preceding motive wave. He also observed that larger degree motive waves had a tendency to develop within a well-defined parallel trend channel. Finally, he noted that the forms of waves 2 and 4 in the motive wave sequence tended to adhere to a principle of alternation, whereby if wave 2 was deep in magnitude and short in duration, then wave 4 tended to be shallow in magnitude and long in duration. As such, we have employed these guidelines in an attempt to put forth a realistic depiction of how we might expect supercycle wave (IV) to playout. It is typical for a corrective wave form to retrace between one-third and two-thirds (or more) of the preceding motive wave at the same degree of trend, but never more than 100%.

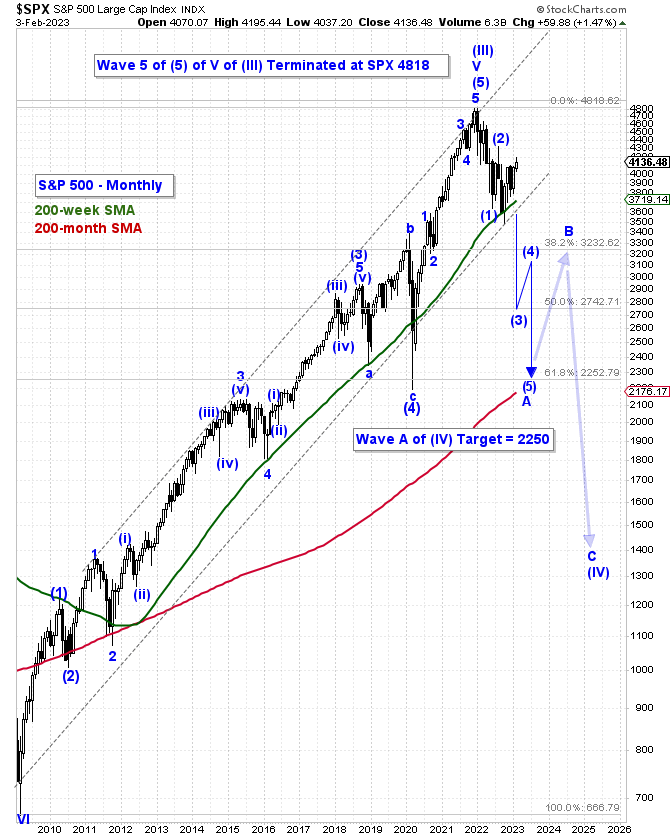

Let’s zoom in now. The monthly range chart of the S&P 500 above illustrates the 13-year advance off the 2009 low. We’ve been counting this leg of the supercycle advance as cycle wave V. The first thing that you might notice is that the decline, thus far, has failed to breach the lower boundary of the rising parallel trend channel. As such, we cannot be 100% certain that the decline is of cycle degree, let alone supercycle degree. But, Cycle wave V meets all of Elliott’s rules and guidelines for a completed motive wave. So, we must assume the worst case scenario until the market proves that assumption to be wrong. At cycle degree of trend, in order for the subsequent corrective wave form to have the right proportional look, it would need to retrace about 50% of the preceding motive wave. More commonly, corrective waves tend to adhere to Fibonacci proportions. The most common retracement is the golden ratio — a Fibonacci 61.8% retracement.

If we were to consider the correction in progress to be occurring at just cycle degree of trend, then our downside expectations would be anchored around the 61.8% retracement level. The key reason for that is because, in addition to the aforementioned commonality of the golden ratio, that level coincides with two other levels that should offer strong support. The first is a previous fourth wave extreme at one lesser degree of trend — the primary wave (4) low, of cycle wave V up. The second is the 200-month simple moving average (red). That gives us a range of SPX 2252-2176 as a good working downside target for cycle wave A, of supercycle wave (IV).

Zooming in further, the weekly range chart of the S&P 500 above illustrates our preferred Elliott Wave count at primary degree of trend. Our working hypothesis is as follows: The five wave decline into the June 17th low completed primary wave (1) down, of cycle wave A down. The three wave countertrend advance into the August 16th high completed primary wave (2) up, of cycle wave A down. Primary wave (3) down, of cycle wave A down has been subdividing at intermediate degree of trend. So far, we can count five waves down into the October 13th low to complete intermediate wave 1, and three waves up into the February 2nd high to complete intermediate wave 2 — both of primary wave (3) down. If our preferred count is correct, then the S&P 500 has already begun a “third-of-a-third” wave decline, which should carry prices sharply lower, into the SPX 2750-2400 range to complete primary wave (3), of cycle wave A down. We currently ascribe a 60% probability to this outcome.

If prices were to extend higher, and exceed the August 16th high, then our preferred count is wrong. That would immediately shift our focus to the alternate count, as illustrated in the weekly range chart of the S&P 500 below. Under this rubric, the August 16th high was most likely only intermediate wave a, of a more lateral, three wave “flat” corrective wave form, which once complete, would then terminate primary wave (2) up, of cycle wave A down. If so, then the October 13th low was wave b, of primary wave (2). The current rally is wave c, of primary wave (2). This is the same pattern and count that we can observe in the DJIA (not shown). If the alternate count becomes operative, then we estimate that there could be additional upside potential for the benchmark index to approximately SPX 4564 — the Fibonacci 78.6% retracement (square root of 61.8%) of primary wave (1) down. We currently ascribe a 30% probability to this outcome.

A new all-time high in the S&P 500 would break the alternate count as well and suggest that the October 13th low marked the worst of the bear market decline. To that outcome, we ascribe only a 10% probability.

From a very short-term perspective, as illustrated in the intraday 4-hour range chart below, the S&P 500 appears to have completed a double-zigzag corrective wave form at Thursday’s intraday high of SPX 4195. A sustained bearish inflection below SPX 4075 would strongly support that conclusion. A break below the December 22nd low would confirm it. Conversely, it’s still possible that prices may need to fill the open chart gap at SPX 4228. That level coincides closely with the Fibonacci 88.6% retracement (square root of 78.6%) at SPX 4230. Again, if prices penetrate the August 16th high it will break the preferred count and shift our focus to the alternate count as discussed above.

Our LT trend following model below has an impeccable track-record of identifying major trend changes. It consists of a base moving average (red) to define the primary trend, and a faster moving average (green) with a 3:2 ratio in order to define the trend change signals. Most recently, the model triggered a negative trend change signal as stock prices came off the March 2022 highs. We are often asked what it would take to turn us bullish. A positive trend change signal would occur if the signal line crossed above the trend line. That would be one key criteria.

Another criteria would be a positive reversal signal in our long-term momentum model. That is to say, any positive M/M reading. For example, the December monthly closing level was -22.04. If the January monthly closing level had come in at just -22.03, then that would have constituted a positive M/M reading. Unfortunately, the January monthly closing level came in lower at -22.79. In order for the model to generate a positive signal, the S&P 500 would need to close the month of February above SPX 4225.

Conclusion

Given the state of affairs with respect to the economy, earnings, valuations, sentiment, and geopolitical risks, would you be at all surprised to hear that we strongly recommend de-risking portfolios following the +8.7% rally in stocks YTD? The total return for the Total U.S. Stock Market ETF (VTI) since the October 12th closing low has been +16.5%. In fact, the average stock in the S&P 500 index (equal-weight) is only down 5.1% since the January 2022 peak. If you were just hoping to get even and get out, then your prayers have pretty much been answered at this point. In our opinion, we are still in the midst of a bear market in stocks. During a bear market, it is wise for investors to focus on preservation of capital. At the current juncture, we recommend minimizing net equity exposure, and maximizing cash reserves.

Let’s consider the four major asset classes from which investors have to choose — stocks, bonds, property, and commodities. Of the four, property is the most overvalued today, now trading at >3 standard deviations above its 40-year historical valuation mean. Stocks aren’t the most overvalued at >1 standard deviation above their 40-year average, but they may be the most volatile. Commodities, on the other hand, are now trading inline with their historical 40-year mean valuation. That leaves bonds. And low and behold, U.S. Treasuries are actually trading at discount to their 40-year historical mean valuation. That doesn’t mean that they can’t get cheaper, but in our view, short-duration U.S. Treasury securities just might offer the best combination of value, safety, liquidity, and income for individual investors who just want to ride out the storm over the next few years.

But there are always trading opportunities! And a case can be made for selectively allocating 10-20% of your investment capital to trading opportunities as they arise. For those who have difficulties finding such trading opportunities in a timely manner, or for those who simply have an interest in seeing regular idea flow, our ALPHA INSIGHTS: Idea Generator Lab publication is included with your paid subscription. The publication highlights our top actionable trade idea each week, and is delivered to your inbox every Wednesday afternoon via email. Our service has produced an impressive track record over the years. In 2022, it was up +19%, while the S&P 500 was down 19% — that’s 3800 bps of net alpha!

Disclaimer

All information and data contained on this site and in reports, analytics, etc. produced by Jeffrey W. Huge (the “author”) is for informational purposes only. The author makes no representations as to accuracy, completeness, suitability, or validity, of any information. The author will not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. All information is provided AS IS with no warranties, and confers no rights.

External links are often provided within the author’s newsletter for the convenience of the reader. The author will not be responsible for any material that is found at the end of these external links.

The author is NOT registered as a securities broker dealer or investment adviser with either the U.S. Securities and Exchange Commission or with any other state or federal securities regulatory authority.

The content of the author’s newsletter should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. The author may hold positions or other interests in securities mentioned, including positions inconsistent with the views expressed.

The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions.

Past performance is no guarantee of future results.