Please enjoy the free portion of this monthly newsletter with our compliments. To get full access, you might want to consider an upgrade to paid for as little as $12/month. As an added bonus, paid subscribers also receive our weekly ALPHA INSIGHTS: Idea Generator Lab publication, which details our top actionable trade idea and provides updated market analysis every Wednesday, as well as other random perks, including periodic ALPHA INSIGHTS: Interim Bulletin reports and quarterly video content.

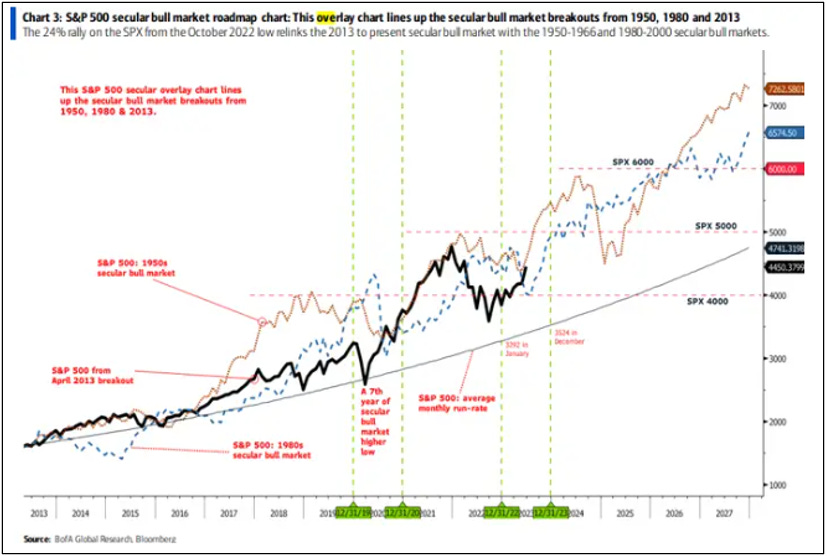

Stock market optimists appear to be focused on three imperatives: 1) An expected decline in the headline inflation rate; 2) A new era of prosperity and technological advancement based upon artificial intelligence; and 3) The magnitude of the current recovery in the major averages. They believe that inflation is poised to recede more swiftly than expected, and as a result, this will limit the Fed’s policy response to just one more rate hike before reversing course next year — thus avoiding a recession. In addition, a new capex spending cycle, driven by the ‘AI’ revolution, is expected to reaccelerate GDP growth and prove transformative to the U.S. economy. Moreover, they assume that the stock market began discounting all of this back in October, and that the 24% rally in the S&P 500 off it’s October low confirms that a new bull market advance is now underway — a la the 1950’s or the 1980’s.

But, things are not always as they seem. Several years ago, we read an academic paper that described a very intriguing concept that the author referred to as an “error pyramid.” It was defined as an intricate, long-standing misconception built around a false premise. The author went on to identify several examples including perhaps the greatest error pyramid ever constructed — the idea of a geocentric universe revolving around the earth. For centuries dating back as far as 340 B.C. — to Aristotle’s On the Heavens, astronomers believed this theory to be fact. Later, in the first century A.D., Ptolemy produced complicated calculations and mathematical models to account for the theoretical motions of the planets in a perceived geocentric solar system, to the point of near perfect prediction. It wasn’t until 1543 that Copernicus finally dispelled this confusion, when he published his own work on celestial mechanics entitled, On the Revolution of the Heavenly Spheres. His curiosity with the retrograde orbit of Mercury, the sole exception to the Ptolemaic model, led him to theorize that the earth revolved around the sun and wiped away centuries of misconception in one stroke.

Given the enormity of Aristotle’s misperception and the magnitude of its impact on the social and economic practices of mankind for nearly two millennia, it occurred to us that if equally colossal error pyramids exist today, it’s possible that they too may employ a similar influence over our current social and economic culture. One candidate that stands out as having the potential to qualify as an error pyramid of similar magnitude in economic terms is the view widely embraced by investors today that the broad stock market represents a sort of permanent source of growth for capital, and that stocks will always outperform bonds over the long-term.

A recent report published by Michael Smolyansky, a Principal Economist at the Federal Reserve, entitled, End of an era: The coming long-run slowdown in corporate profit growth and stock returns, exposes some of the major weaknesses to that view. The central finding of the report, which analyzes 60 years of data on earnings and stock price performance from 1962 to 2022, is that from 1989 to 2019, real corporate profits grew at nearly double the annual rate at which they grew in the period from 1962 to 1989. The report goes on to point out that lower interest expense and corporate tax rates from 1989 to 2019 mechanically explain most of the difference in the real growth rate of corporate profits during the two periods. In addition, the persistent decline in the risk-free rate alone accounts for all of the expansion in price-to-earnings multiples. Finally, the report concludes that the boost to profits and valuations from ever-declining interest and corporate tax rates is unlikely to continue due to the fact that they have very little scope to fall below their 2019 levels, indicating significantly lower future profit growth and stock returns.

Indeed, even before the pandemic-induced collapse of long-term interest rates to sub-one percent levels, the 10-year Treasury yield ended 2019 at approximately 1.9%. If the Fed were to eventually achieve its long-term inflation target of 2.0%, it’s unlikely that 10-year Treasury yields will fail to exceed that level on any sustained basis. A 10-year Treasury yield that also averages 2.0% would imply that the U.S. government will be able to lock-in 10-year funding at an average real cost of zero. Effective corporate tax rates are also unlikely to to fall much further if at all, as the Inflation Reduction Act of 2022 imposed a 15% corporate minimum tax. And with the ratio of U.S. debt-to-GDP near all-time highs, neither should investors expect another deficit financed corporate tax cut like the Tax Cuts and Jobs Act of 2017 anytime soon.

Economic Conundrum

But isn’t the economy recovering? Unemployment is low and inflation is falling. Why shouldn’t the stock market continue its bull market? As all will know, following the shut down of the global economy during the early days of the COVID-19 pandemic, governments and central banks around the world took emergency actions to resuscitate their economies as they went into cardiac arrest. In the U.S., the Federal